Globally, grain prices appear to be trending gradually upward with the UN’s FAO Cereal Price Index—which tracks world prices for wheat, maize, rice and barley—up by 1.5% in November from the month before, although it is notable that the 2023 average level for the same index was 15.4% below the 2022 average (albeit a year with historically elevated commodity prices). European Union soft wheat production is predicted by Strategie Grains to fall slightly by 1% YoY in 2024 to 124.8 Mt (from 2023’s 125.9 Mt). On the other hand, the analysts expect to see EU barley output to rise by 11% YoY this year to 52.7 Mt (despite a 0.8% YoY drop in winter barley sowings). The European Commission recently raised its forecast for usable production of EU maize for the 2023/24 season to 61.4 Mt (from an earlier 59.9 Mt made a month prior). This would be 15.6% above the previous season’s output, a period in which drought conditions adversely affected much of the EU maize crop, but nonetheless still 10.8% below the five-year average.

Globally, grain prices appear to be trending gradually upward with the UN’s FAO Cereal Price Index—which tracks world prices for wheat, maize, rice and barley—up by 1.5% in November from the month before, although it is notable that the 2023 average level for the same index was 15.4% below the 2022 average (albeit a year with historically elevated commodity prices). European Union soft wheat production is predicted by Strategie Grains to fall slightly by 1% YoY in 2024 to 124.8 Mt (from 2023’s 125.9 Mt). On the other hand, the analysts expect to see EU barley output to rise by 11% YoY this year to 52.7 Mt (despite a 0.8% YoY drop in winter barley sowings). The European Commission recently raised its forecast for usable production of EU maize for the 2023/24 season to 61.4 Mt (from an earlier 59.9 Mt made a month prior). This would be 15.6% above the previous season’s output, a period in which drought conditions adversely affected much of the EU maize crop, but nonetheless still 10.8% below the five-year average.

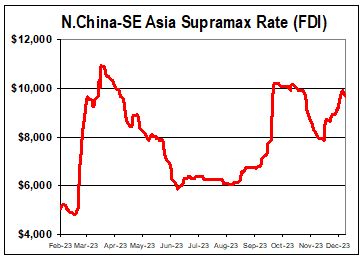

Pressure has been notable on Supramax spot freights over the past week even as trends have not been as uniformly deflationary as in other markets with average inter-Pacific rates losing around US$ 500 week-on-week. Current NoPac rounds for 58,000 dwt ships, for instance, are now trading within the high US$ 10,000s daily range in contrast to the lower US$ 11,000s as seen a week earlier during the most recent course correction. Short period deals on Ultramax vessels are still looking rather robust with 3-5 months being secured in excess of US$ 16,500 daily.

Pressure has been notable on Supramax spot freights over the past week even as trends have not been as uniformly deflationary as in other markets with average inter-Pacific rates losing around US$ 500 week-on-week. Current NoPac rounds for 58,000 dwt ships, for instance, are now trading within the high US$ 10,000s daily range in contrast to the lower US$ 11,000s as seen a week earlier during the most recent course correction. Short period deals on Ultramax vessels are still looking rather robust with 3-5 months being secured in excess of US$ 16,500 daily.

Corrections have been evident within the eastern basin Handysizes with Pacific rounds on tonnage of 38-42,000 dwt having moved downward from the upper US$ 9,000s into the lower US$ 9,000s over the past week period. Shipowners do say that they expect to see some firming in demand going into the year-end holiday period.

For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

With the ever-important holiday period bearing down in the next few weeks, traders, owners and charterers alike are all looking at the writing on the wall, hoping to put in their last-minute year-ending requirements at the best possible profit. As such, market fundamentals remain locked into a largely sideways path even as there are no longer signs of bunker prices rising enough to push operating costs any higher than they were at the start of the month. Northbound trips are still fetching rates just below €50/mt from the Spanish Med into the North Sea with some reports of rates even exceeding €50/mt on redelivery Ireland. Southbound freights from Ireland into the lower Baltic are securing rates in the middle-high €20s/mt with at least one owner claiming to have fixed €30/mt on this business with agri-prods of 5,000mt (46′). Charterers are said to be behaving slightly more accommodating for fixing urgent business on Baltic delivery with the BMTI benchmark rates from the Baltic States to ARAG seen pushing slightly higher into the mid-high €20s/mt range and talk of €27-28/mt being done on some cargoes ex-Klaipeda even if the prevailing rates are still largely in the vicinity of €26/mt on this run. Stormy weather rolling across the North Sea and northern Continent is said to be getting even worse, which has driven a number of delays and cancellations, which are in turn impinging on overall tonnage availability, ultimately propping up freights by an uncertain degree.

With the ever-important holiday period bearing down in the next few weeks, traders, owners and charterers alike are all looking at the writing on the wall, hoping to put in their last-minute year-ending requirements at the best possible profit. As such, market fundamentals remain locked into a largely sideways path even as there are no longer signs of bunker prices rising enough to push operating costs any higher than they were at the start of the month. Northbound trips are still fetching rates just below €50/mt from the Spanish Med into the North Sea with some reports of rates even exceeding €50/mt on redelivery Ireland. Southbound freights from Ireland into the lower Baltic are securing rates in the middle-high €20s/mt with at least one owner claiming to have fixed €30/mt on this business with agri-prods of 5,000mt (46′). Charterers are said to be behaving slightly more accommodating for fixing urgent business on Baltic delivery with the BMTI benchmark rates from the Baltic States to ARAG seen pushing slightly higher into the mid-high €20s/mt range and talk of €27-28/mt being done on some cargoes ex-Klaipeda even if the prevailing rates are still largely in the vicinity of €26/mt on this run. Stormy weather rolling across the North Sea and northern Continent is said to be getting even worse, which has driven a number of delays and cancellations, which are in turn impinging on overall tonnage availability, ultimately propping up freights by an uncertain degree.

Subscribe to the BMTI Short Sea Report today for exclusive news on the European Short Sea markets.

Following an extended period of ups and downs, Capesize rates hit the first proper week of November with a major surge of recovery. Gains have been especially notable in the Pacific where the going rates for Pac RVs have jumped by as much as US$ 4,000 in 48 hours to trading in the high teens of US$ 17-18,000 daily—no small feat considering the same rates were in the low teens just a few days before.

Following an extended period of ups and downs, Capesize rates hit the first proper week of November with a major surge of recovery. Gains have been especially notable in the Pacific where the going rates for Pac RVs have jumped by as much as US$ 4,000 in 48 hours to trading in the high teens of US$ 17-18,000 daily—no small feat considering the same rates were in the low teens just a few days before.

Atlantic Panamaxes appear to be mounting a mild recovery if the past day of trading is any indication. Owners of 82,000 dwt vessels are fetching upwards of US$ 15,000 daily at the moment when they were settling for US$ 14,000s this time a week before. New front haul trips are also edging upward ever so slowly with US$ 22-23,000 daily range rates now showing buoyancy in heading toward US$ 23,000.

There has been increased talk of a weaker feel and owners’ willingness to compromise, which does not stop the market to become an intense battle ground for tonnage in the medium and long term future. The technical challenge to meet the decarbonisation standards is one problem, but the costs involved to meet these new standards could force many owners out of business. Thus, the owning landscape could be up for a profound change. As a consequence, as outlined earlier this week, decarbonisation might lead to a temporary lack of tonnage and, as a consequence, could severely hamper global trade. At any rate, the spot market remains in good health, despite a weaker sentiment. Off the Continent, a 28,000 dwt vessel got fixed at US$ 13,500 daily for a trip to the eastern Med. Handysize freights for trips to West Africa are hovering at around US$ 18-20,000 daily.

There has been increased talk of a weaker feel and owners’ willingness to compromise, which does not stop the market to become an intense battle ground for tonnage in the medium and long term future. The technical challenge to meet the decarbonisation standards is one problem, but the costs involved to meet these new standards could force many owners out of business. Thus, the owning landscape could be up for a profound change. As a consequence, as outlined earlier this week, decarbonisation might lead to a temporary lack of tonnage and, as a consequence, could severely hamper global trade. At any rate, the spot market remains in good health, despite a weaker sentiment. Off the Continent, a 28,000 dwt vessel got fixed at US$ 13,500 daily for a trip to the eastern Med. Handysize freights for trips to West Africa are hovering at around US$ 18-20,000 daily.

Freights from the Sea of Azov have rocketed by as much as US$ 8/mt week-on-week due to extreme unavailability of tonnage and the associated delays in passing the Kerch Strait. Current delays are said to be averaging 8-15 days with little immediate relief in sight. Rising opex (spurred by rising bunker prices) are giving owners one more reason to hike their rate ideas from last-done going into the last quarter of the year. With Yeisk delivery to Marmara, standard grain cargoes are fetching high US$ 60s/mt of up to US$ 69/mt while Rostov delivery with the same redel is said to be trading beyond US$ 70/mt with some reports of even US$ 73-74/mt done. Danube freights remain volatile with Reni/Marmara grains in the range of US$ 40-45/mt, depending on terms. For news and trends in the European short sea markets every week, subscribe to the BMTI Short Sea Report.

Freights from the Sea of Azov have rocketed by as much as US$ 8/mt week-on-week due to extreme unavailability of tonnage and the associated delays in passing the Kerch Strait. Current delays are said to be averaging 8-15 days with little immediate relief in sight. Rising opex (spurred by rising bunker prices) are giving owners one more reason to hike their rate ideas from last-done going into the last quarter of the year. With Yeisk delivery to Marmara, standard grain cargoes are fetching high US$ 60s/mt of up to US$ 69/mt while Rostov delivery with the same redel is said to be trading beyond US$ 70/mt with some reports of even US$ 73-74/mt done. Danube freights remain volatile with Reni/Marmara grains in the range of US$ 40-45/mt, depending on terms. For news and trends in the European short sea markets every week, subscribe to the BMTI Short Sea Report.

After ending last week on a bit of a down note, Capesizes start the new week with something of a surprising return to positivity with stabilizing trends in the Atlantic and continued buoyancy in the Pacific. Pacific round voyage rates have been especially bullish of late with owners who had taken US$ 11,000s last week already heard to be asking charterers for US$ 12,000s on mid-September dates. Panamaxes have turned into a split market with geographically eastern rates out-performing their western counterparts. Trans-Atlantic RVs are falling by some US$ 300-400 day-on-day (into the low US$ 22,000s) while Pacific RVs are increasing by around the same amount on a daily basis to trade in the middle US$ 11,000s. Southeast Asia is thriving as well with Indo rounds moving above US$ 10,000. Supramax rates are climbing across the board thanks to a convergence of global chokepoints that are making available tonnage slightly harder to hire in both hemispheres. In the East, a 58,000 dwt vessel has secured a rate of about US$ 17,000 daily going from Madagascar to China. Short period time charters are getting concluded at upwards of US$ 15,000 daily on Handymax tonnage open in the PG-WCI area.

After ending last week on a bit of a down note, Capesizes start the new week with something of a surprising return to positivity with stabilizing trends in the Atlantic and continued buoyancy in the Pacific. Pacific round voyage rates have been especially bullish of late with owners who had taken US$ 11,000s last week already heard to be asking charterers for US$ 12,000s on mid-September dates. Panamaxes have turned into a split market with geographically eastern rates out-performing their western counterparts. Trans-Atlantic RVs are falling by some US$ 300-400 day-on-day (into the low US$ 22,000s) while Pacific RVs are increasing by around the same amount on a daily basis to trade in the middle US$ 11,000s. Southeast Asia is thriving as well with Indo rounds moving above US$ 10,000. Supramax rates are climbing across the board thanks to a convergence of global chokepoints that are making available tonnage slightly harder to hire in both hemispheres. In the East, a 58,000 dwt vessel has secured a rate of about US$ 17,000 daily going from Madagascar to China. Short period time charters are getting concluded at upwards of US$ 15,000 daily on Handymax tonnage open in the PG-WCI area.

For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

Freights were generally improved over the past week among the Far East Supramaxes, holidays in Singapore and spotty activity notwithstanding, as average rates seem to have picked up around US$ 300-500 week-on-week (basis NoPac RV with tonnage of 58,000 dwt). Indeed, the inter-Pacific round voyage freights rose steadily from the middle US$ 6,000s to nearly US$ 7,000 daily over the course of the week with Indo rounds closing above US$ 8,500 daily. Handysize rates were reported as extremely buoyant on the northbound run with delivery Southeast Asia to NoPac rising by almost US$ 750 week-on-week (basis 38-42,000 dwt) to exceed the US$ 8,000 line.

Freights were generally improved over the past week among the Far East Supramaxes, holidays in Singapore and spotty activity notwithstanding, as average rates seem to have picked up around US$ 300-500 week-on-week (basis NoPac RV with tonnage of 58,000 dwt). Indeed, the inter-Pacific round voyage freights rose steadily from the middle US$ 6,000s to nearly US$ 7,000 daily over the course of the week with Indo rounds closing above US$ 8,500 daily. Handysize rates were reported as extremely buoyant on the northbound run with delivery Southeast Asia to NoPac rising by almost US$ 750 week-on-week (basis 38-42,000 dwt) to exceed the US$ 8,000 line.

For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

The fall in spot freights has, by all signs, accelerated over the course of July with owners no longer able to depend on securing last-done levels save the very rarest of special agreements. The seasonal culprits of holiday-driven demand drift and a wider slowing in manufacturing operations that fuel that demand are both gaining force to combine into a bearish vortex that are putting charterers in the driver’s seat and owners on the sidelines. While week-on-week discounts have yet to exceed EUR 0.5/mt on any observed trade route, this is still an expanding average differential when compared to the EUR 0.25/mt limit seen until just a few weeks ago. Westward-bound freights from the Baltic States to ARAG have fallen into the EUR 21-23/mt range after trading in the EUR 22-24/mt range at the end of June and as much as EUR 25-28/mt in the first quarter of the year.

The fall in spot freights has, by all signs, accelerated over the course of July with owners no longer able to depend on securing last-done levels save the very rarest of special agreements. The seasonal culprits of holiday-driven demand drift and a wider slowing in manufacturing operations that fuel that demand are both gaining force to combine into a bearish vortex that are putting charterers in the driver’s seat and owners on the sidelines. While week-on-week discounts have yet to exceed EUR 0.5/mt on any observed trade route, this is still an expanding average differential when compared to the EUR 0.25/mt limit seen until just a few weeks ago. Westward-bound freights from the Baltic States to ARAG have fallen into the EUR 21-23/mt range after trading in the EUR 22-24/mt range at the end of June and as much as EUR 25-28/mt in the first quarter of the year.

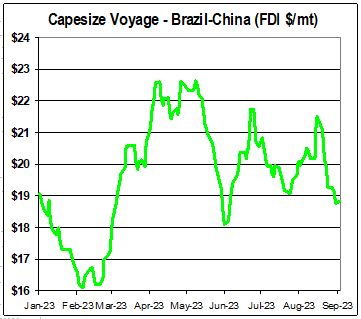

Even with the ECSA still providing just enough cargo demand to keep Brazil/China voyages hovering at US$ 20.8/mt, Capesize freights are looking at an increasingly thin upside with charterers and owners coming to something of an impasse. Pacific round voyages are also holding to circa US$ 8.2/mt, but owners are struggling to push those levels any higher for mid-July positions. Pac round time charters are under pressure in the US$ 13,000s range.

Even with the ECSA still providing just enough cargo demand to keep Brazil/China voyages hovering at US$ 20.8/mt, Capesize freights are looking at an increasingly thin upside with charterers and owners coming to something of an impasse. Pacific round voyages are also holding to circa US$ 8.2/mt, but owners are struggling to push those levels any higher for mid-July positions. Pac round time charters are under pressure in the US$ 13,000s range.

Atlantic Panamaxes are at something of an equilibrium with charterers unable to push rates for TARVs any lower than US$ 6,500 while owners are hoping to keep them above US$ 7,000 daily at the same time. South America remains the great hope to turn things around and despite continued strength from the ECSA export market, the rest of the Atlantic is far less inspiring. New front haul business is also seen stabilizing with Kamsarmaxes said to be securing upwards of US$ 15,000 daily plus US$ 500,000 BB.

Chinese holidays are probably the biggest story in the eastern Supramax trades, although they don’t seem to have subdued rates as much as they have activity with standard NoPac rounds on 58,000 dwt ships having remained largely unchanged over the past week in the US$ 7,000s. Ultramaxes are heard to be securing over US$ 8,000 on inter-Pac rounds from Singapore-Japan into SE Asia as avails tighten. Handysize activity has notably fallen off in recent days even as spot freight levels have come under the kinds of discounts that are not normally assumed to hit the small size sector with northbound rates ex-SE Asia to NoPac losing US$ 300-400 week-on-week.

Chinese holidays are probably the biggest story in the eastern Supramax trades, although they don’t seem to have subdued rates as much as they have activity with standard NoPac rounds on 58,000 dwt ships having remained largely unchanged over the past week in the US$ 7,000s. Ultramaxes are heard to be securing over US$ 8,000 on inter-Pac rounds from Singapore-Japan into SE Asia as avails tighten. Handysize activity has notably fallen off in recent days even as spot freight levels have come under the kinds of discounts that are not normally assumed to hit the small size sector with northbound rates ex-SE Asia to NoPac losing US$ 300-400 week-on-week.

For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

The condition of the French soft wheat crop is its best in over a decade, says national agricultural agency FranceAgriMer. The agency says about 93% of the crop is in “good or excellent” condition compared to just 69% measured at this time last year and also the highest level since measurements began in 2011.

The condition of the French soft wheat crop is its best in over a decade, says national agricultural agency FranceAgriMer. The agency says about 93% of the crop is in “good or excellent” condition compared to just 69% measured at this time last year and also the highest level since measurements began in 2011.

Prices for thermal coal worldwide have been stabilizing at around US$ 200/mt or less than half of last year’s record of circa US$ 440/mt reached in Q3 of 2022 (basis Newcastle). Observers note that present spot market prices are nonetheless more than twice the ten-year average for seaborne thermal coal before Russia’s invasion of Ukraine (US$ 86/mt).

Owners of Capesize tonnage continue to insist that enquiry is high and charterers are putting in new orders despite the fact that average rates continue to slide across the board. Whether the corrections will persist into the week ahead remains to be seen, but a stronger wave of demand would be needed to soak up the plentiful avails that are awash in both hemispheres, presenting challenges to owners who were hoping to lock in some last-minute business before the summer months start to bring a lull in earnest.

Owners of Capesize tonnage continue to insist that enquiry is high and charterers are putting in new orders despite the fact that average rates continue to slide across the board. Whether the corrections will persist into the week ahead remains to be seen, but a stronger wave of demand would be needed to soak up the plentiful avails that are awash in both hemispheres, presenting challenges to owners who were hoping to lock in some last-minute business before the summer months start to bring a lull in earnest.

Lo and behold, it would appear that Panamax trends are starting to stabilize on the day-to-day spot market. Or at least the beginning of the week saw daily declines slow to a trickle in both hemispheres as TARVs steadied in the US$ 9,000s and front haul trips seemed to have lost the desire to drift below US$ 19,000 daily. There are even a few rumours of new demand in Southeast Asia, pushing rates into modest positivity based on early June positions. Indo rounds on Kamsarmaxes are in the US$ 8,000s.

Holidays here and holidays there (not to mention the odd historic coronation in between) are putting the brakes on business activity to a notable degree across the North Sea and, to a less extent, the Baltic market as well. Coaster trades are nonetheless more stable than one might expect them to be at this juncture with week-on-week losses looking rather minimal. On the other hand, compared to this time a year ago, rate levels have declined rather steadily and unrelentingly in the past 12 months with inter-Baltic westward freights now in the low EUR 20s/mt (basis general cargoes of 5,000mt) whereas the same business was fetching mid-high EUR 30s/mt in May of 2022. Admittedly, this was at extraordinarily high levels compared to the historical average, benefiting from the remainder of positive market vibes from the mighty upsurge of 2021. But this year’s nominal return to normality has not been as brutal as many predicted it might be. Baltic-based short sea owners are still making profits from their agreements even if earnings are nothing like they were 1-2 years ago. Northbound freights from the GNS are fetching mid-EUR 20s/mt of up to EUR 25/mt based on Irish Sea redelivery even as they began the year trading in the EUR 30s/mt. Southbound freights fixed from the UK North Sea to the Sea of Marmara are no longer fetching EUR 50s/mt as they did a month ago, but 3,000mt generals can still get high EUR 40s/mt.

Holidays here and holidays there (not to mention the odd historic coronation in between) are putting the brakes on business activity to a notable degree across the North Sea and, to a less extent, the Baltic market as well. Coaster trades are nonetheless more stable than one might expect them to be at this juncture with week-on-week losses looking rather minimal. On the other hand, compared to this time a year ago, rate levels have declined rather steadily and unrelentingly in the past 12 months with inter-Baltic westward freights now in the low EUR 20s/mt (basis general cargoes of 5,000mt) whereas the same business was fetching mid-high EUR 30s/mt in May of 2022. Admittedly, this was at extraordinarily high levels compared to the historical average, benefiting from the remainder of positive market vibes from the mighty upsurge of 2021. But this year’s nominal return to normality has not been as brutal as many predicted it might be. Baltic-based short sea owners are still making profits from their agreements even if earnings are nothing like they were 1-2 years ago. Northbound freights from the GNS are fetching mid-EUR 20s/mt of up to EUR 25/mt based on Irish Sea redelivery even as they began the year trading in the EUR 30s/mt. Southbound freights fixed from the UK North Sea to the Sea of Marmara are no longer fetching EUR 50s/mt as they did a month ago, but 3,000mt generals can still get high EUR 40s/mt.

To get exclusive news and trend analysis on the European short sea markets on a weekly basis, subscribe to the BMTI Short Sea Report.

The Pacific Supramax freights have remained largely buoyant over the past week with average rates for NoPac rounds gaining some US$ 750-1,000 week-on-week to settle at rates of around US$ 10,500 with reports of as much as US$ 11,000 in negotiations in tonnage of 58,000 dwt. Indeed, backhaul rates have already been reported at this level on Ultramaxes ex-ECI back to the Continent. Indonesia rounds are also climbing back quickly compared to weeks past with upwards of US$ 14,500 daily not available on tonnage of 58,000 dwt (ex-WCI) and as much as US$ 16,000 on tonnage of 62,000 dwt. Unlike the larger Supras and Ultras, eastern Handysize rates have not increased noticeably over the past week, although they have not decreased either. This stability is what owners have come to expect and last few days have born that out. N.China delivery of 38-42,000 dwt tonnage to CJK or S.Korea is about as likely to secure about US$ 10,250 daily as it was a week earlier. Steel cargoes are being shipped on tonnage of 42,000 dwt ex-S.China to the UKC-Med at up to US$ 13,000, brokers say. Trips from the Singapore-Japan area to Southeast Asia on standard Handy tonnage are fetching mid US$ 9,000s.

The Pacific Supramax freights have remained largely buoyant over the past week with average rates for NoPac rounds gaining some US$ 750-1,000 week-on-week to settle at rates of around US$ 10,500 with reports of as much as US$ 11,000 in negotiations in tonnage of 58,000 dwt. Indeed, backhaul rates have already been reported at this level on Ultramaxes ex-ECI back to the Continent. Indonesia rounds are also climbing back quickly compared to weeks past with upwards of US$ 14,500 daily not available on tonnage of 58,000 dwt (ex-WCI) and as much as US$ 16,000 on tonnage of 62,000 dwt. Unlike the larger Supras and Ultras, eastern Handysize rates have not increased noticeably over the past week, although they have not decreased either. This stability is what owners have come to expect and last few days have born that out. N.China delivery of 38-42,000 dwt tonnage to CJK or S.Korea is about as likely to secure about US$ 10,250 daily as it was a week earlier. Steel cargoes are being shipped on tonnage of 42,000 dwt ex-S.China to the UKC-Med at up to US$ 13,000, brokers say. Trips from the Singapore-Japan area to Southeast Asia on standard Handy tonnage are fetching mid US$ 9,000s.

For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

Off the Continent, an Ultramax was taken for a trip to the East at US$ 20,000 daily, and at US$ 15,500 daily for a trip tip to West Africa on Supra tonnage. Ultra scrap TC rates are hovering around US$ 13,500-14,000 daily. The Black Sea looks stable with 30,000mt booked from Romania to the East Med at TCE of US$ 13,500 daily. Rates are still sounding okay from the Med where clinker charterers took an Ultra at US$ 18,000 daily to West Africa. Grain charterers are linked with a 30,000mt cargo from Romania to the Adriatic at a TCE of 13,500 daily. A 36,000 dwt is rumoured as done at US$ 11,000 daily for 5-7 months of trading. From West Africa, Ultra owners were rating a trip via South Africa to the East at US$ 18,000 daily. A Handy of 33,000 dwt was ballasted to Santos to get fixed at US$ 14,000 daily for a trip to Morocco, which isn’t really exciting.

Off the Continent, an Ultramax was taken for a trip to the East at US$ 20,000 daily, and at US$ 15,500 daily for a trip tip to West Africa on Supra tonnage. Ultra scrap TC rates are hovering around US$ 13,500-14,000 daily. The Black Sea looks stable with 30,000mt booked from Romania to the East Med at TCE of US$ 13,500 daily. Rates are still sounding okay from the Med where clinker charterers took an Ultra at US$ 18,000 daily to West Africa. Grain charterers are linked with a 30,000mt cargo from Romania to the Adriatic at a TCE of 13,500 daily. A 36,000 dwt is rumoured as done at US$ 11,000 daily for 5-7 months of trading. From West Africa, Ultra owners were rating a trip via South Africa to the East at US$ 18,000 daily. A Handy of 33,000 dwt was ballasted to Santos to get fixed at US$ 14,000 daily for a trip to Morocco, which isn’t really exciting.

The Capesize market is showing more activity on the iron ore routes with some stabilized freight rates in the high US$ 7s/mt for mid-April loading out of Western Australia into China. The trans-Pacific rounds are firming with rates talked in the low/mid US$ 13,000s daily. In the Atlantic some demand from West Africa is supporting freight rates, but from Brazil business remains low with freight rates in the mid-high US$ 20s/mt. Front hauls hover in the range of US$ 29,000 per day. The firming trend for the Panamax rates continues with gains in the three-digital range day-on-day realized on nearly every major route and interesting opportunities seen in both hemispheres. Increasing demand for period chartering in the Pacific is evident with middle-aged vessels open in Southern China for short-period trading rumoured in the range of US$ 14-15,000 daily for delivery beginning April. The Indonesian round seems to be the only exception with the spot rates having difficulty clinging to last-done levels. The downward trend for Handy bulk rates is unbroken with declines of more than US$ 1,000 per day seen on the Indonesian round for Supra tonnage. Fresh activity is not very abundant and the Pacific basin is generally losing more steam than the Atlantic. An older 56,000 dwt failed at US$ 12,500 daily for a trip via Indonesia with destination South Korea and delivery Southern China. An Ultramax is being talked about on subs for about US$ 19,000 daily for an iron ore trip from Guatemala via WCSA to China. Demand for Handysize shipments in the East Med and Black Sea seems to be positive, which is supporting rates in the region and is even driving firming trends along the trans-Atlantic routes. For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

The Capesize market is showing more activity on the iron ore routes with some stabilized freight rates in the high US$ 7s/mt for mid-April loading out of Western Australia into China. The trans-Pacific rounds are firming with rates talked in the low/mid US$ 13,000s daily. In the Atlantic some demand from West Africa is supporting freight rates, but from Brazil business remains low with freight rates in the mid-high US$ 20s/mt. Front hauls hover in the range of US$ 29,000 per day. The firming trend for the Panamax rates continues with gains in the three-digital range day-on-day realized on nearly every major route and interesting opportunities seen in both hemispheres. Increasing demand for period chartering in the Pacific is evident with middle-aged vessels open in Southern China for short-period trading rumoured in the range of US$ 14-15,000 daily for delivery beginning April. The Indonesian round seems to be the only exception with the spot rates having difficulty clinging to last-done levels. The downward trend for Handy bulk rates is unbroken with declines of more than US$ 1,000 per day seen on the Indonesian round for Supra tonnage. Fresh activity is not very abundant and the Pacific basin is generally losing more steam than the Atlantic. An older 56,000 dwt failed at US$ 12,500 daily for a trip via Indonesia with destination South Korea and delivery Southern China. An Ultramax is being talked about on subs for about US$ 19,000 daily for an iron ore trip from Guatemala via WCSA to China. Demand for Handysize shipments in the East Med and Black Sea seems to be positive, which is supporting rates in the region and is even driving firming trends along the trans-Atlantic routes. For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

Defying the pessimists, Capesize markets seem to have a bit of energy left to spare with a new round of activity in the eastern basin helping push the Pacific RV back into positive territory and into the US$ 19,000s once again. Whether rates will stay buoyant on this route and, perhaps more importantly, start to inspire other bullish bounces around the market, remains very much to be seen. But Capesize owners are happy to see that a true correction in spot market freight trends is far from a foregone conclusion.

Defying the pessimists, Capesize markets seem to have a bit of energy left to spare with a new round of activity in the eastern basin helping push the Pacific RV back into positive territory and into the US$ 19,000s once again. Whether rates will stay buoyant on this route and, perhaps more importantly, start to inspire other bullish bounces around the market, remains very much to be seen. But Capesize owners are happy to see that a true correction in spot market freight trends is far from a foregone conclusion.

The Capesizes do not appear to be running out of steam any time soon with the week kicking off with strong improvements nearly across the board as trans-Atlantic RVs near the US$ 11,000s and front hauls trips seem bound to reach US$ 25,000 daily by mid-week. Pacific-based round voyage business is also quite bullish at the moment with owners securing upwards of US$ 13,000 daily on standard RV basis (despite charterers’ efforts to lock in US$ 11-12,000) or about double the rates of two weeks ago.

The Capesizes do not appear to be running out of steam any time soon with the week kicking off with strong improvements nearly across the board as trans-Atlantic RVs near the US$ 11,000s and front hauls trips seem bound to reach US$ 25,000 daily by mid-week. Pacific-based round voyage business is also quite bullish at the moment with owners securing upwards of US$ 13,000 daily on standard RV basis (despite charterers’ efforts to lock in US$ 11-12,000) or about double the rates of two weeks ago.

The holidays don’t seem to have ended just yet for the northern European trades, at least in terms of business activity, with cargo demand being assessed as sluggish across the board and open tonnage starting to pile up along nearly every standard route. This has provided some advantageous rate levels for the charterers who have waded into the market in the early days of 2023 with inter-Baltic rates in the westward direction having lost as much as EUR 2/ mt from their levels of mid-December as general cargoes of 5,000mt are able to secure EUR 24-25/mt from Klaipeda to ARAG whereas the same would not have fallen under EUR 26/mt in the ‘normal’ days of Q4-2022, shipbrokers assert. Ice class requirements and stable bunker prices are shoring up freights to some degree, but the lack of steady business, on the whole, is giving charterers plenty of tonnage options to pick and choose from. Brokers doubt this very quiet market climate will continue for much longer, but those opportunistic few that have cargo to move are taking advantage of the situation. Northbound trips from Spanish Med to ECUK are fetching high EUR 30s/mt at upwards of EUR 38/mt on 3-4,000mt agri-prod cargoes while the opposite direction is giving closer to EUR 35/mt.

The holidays don’t seem to have ended just yet for the northern European trades, at least in terms of business activity, with cargo demand being assessed as sluggish across the board and open tonnage starting to pile up along nearly every standard route. This has provided some advantageous rate levels for the charterers who have waded into the market in the early days of 2023 with inter-Baltic rates in the westward direction having lost as much as EUR 2/ mt from their levels of mid-December as general cargoes of 5,000mt are able to secure EUR 24-25/mt from Klaipeda to ARAG whereas the same would not have fallen under EUR 26/mt in the ‘normal’ days of Q4-2022, shipbrokers assert. Ice class requirements and stable bunker prices are shoring up freights to some degree, but the lack of steady business, on the whole, is giving charterers plenty of tonnage options to pick and choose from. Brokers doubt this very quiet market climate will continue for much longer, but those opportunistic few that have cargo to move are taking advantage of the situation. Northbound trips from Spanish Med to ECUK are fetching high EUR 30s/mt at upwards of EUR 38/mt on 3-4,000mt agri-prod cargoes while the opposite direction is giving closer to EUR 35/mt.

To get exclusive news and trend analysis on the European short sea markets on a weekly basis, subscribe to the BMTI Short Sea Report.

The first working day of the new year was more an extension of the Christmas-New Year break. With London, plus a few other places off, there is hardly anything worth reporting. But one thing can be taken for granted and that is that charterers will keep endeavouring to push rates down further to test the owners’ limits. And, now, seeing charterers rating a 37,000 dwt vessel at US$ 8,000 daily for a trip from Finland into the East Med is right in line with the prevailing bearish sentiment. For the first quarter of 2023, Handysize tonnage will be unlikely to do any better than around this level for trips to the Med, ECSA and US Gulf…for West Africa maybe US$ 11-12,000 daily would be possible. Handysize rates for trading across the East have been falling apace with charterers seen rating a 32,000 dwt for a trip from China to Indonesia at US$ 5,500 daily. Australian rounds are being closely traded at around US$ 7,500 daily with delivery South India, at which a similar level was also agreed on a 30,000 dwt vessel for a 15-day employment in Southeast Asia. Back haul charterers want the rate for a 32,000 dwt to be down below US$ 7,000 daily for a trip to the Continent. Amongst this unpleasant news, the freight rate of US$ 9,500 daily on a 32,000 dwt for a trip from PG via South Africa to WC India is a welcome highlight.

The first working day of the new year was more an extension of the Christmas-New Year break. With London, plus a few other places off, there is hardly anything worth reporting. But one thing can be taken for granted and that is that charterers will keep endeavouring to push rates down further to test the owners’ limits. And, now, seeing charterers rating a 37,000 dwt vessel at US$ 8,000 daily for a trip from Finland into the East Med is right in line with the prevailing bearish sentiment. For the first quarter of 2023, Handysize tonnage will be unlikely to do any better than around this level for trips to the Med, ECSA and US Gulf…for West Africa maybe US$ 11-12,000 daily would be possible. Handysize rates for trading across the East have been falling apace with charterers seen rating a 32,000 dwt for a trip from China to Indonesia at US$ 5,500 daily. Australian rounds are being closely traded at around US$ 7,500 daily with delivery South India, at which a similar level was also agreed on a 30,000 dwt vessel for a 15-day employment in Southeast Asia. Back haul charterers want the rate for a 32,000 dwt to be down below US$ 7,000 daily for a trip to the Continent. Amongst this unpleasant news, the freight rate of US$ 9,500 daily on a 32,000 dwt for a trip from PG via South Africa to WC India is a welcome highlight.

For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

It seems far too early to call the Capesizes over with their week-starting slump looking increasingly like a temporary bump on a steadily rising pathway. Levels on long haul rates have jumped into action in East and West alike with only the Pacific RVs taking longer to catch up, still falling by US$ 500 day-on-day, but looking more likely to bounce back before the week is through. Otherwise, rates like the front haul and trans-Atlantic RV are gaining some US$ 2,000 day-on-day with the former reaching US$ 32,000 and the latter easily exceeding US$ 20,000 daily as owners seek to fix US$ 21,000 and higher.

It seems far too early to call the Capesizes over with their week-starting slump looking increasingly like a temporary bump on a steadily rising pathway. Levels on long haul rates have jumped into action in East and West alike with only the Pacific RVs taking longer to catch up, still falling by US$ 500 day-on-day, but looking more likely to bounce back before the week is through. Otherwise, rates like the front haul and trans-Atlantic RV are gaining some US$ 2,000 day-on-day with the former reaching US$ 32,000 and the latter easily exceeding US$ 20,000 daily as owners seek to fix US$ 21,000 and higher.

Far East Supramaxes launched a recovery of sorts in the final days of the week, leaving NoPac rounds as much as US$ 1,500 higher than they started the week and average rates (basis N.China delivery) in the middle US$ 8,000s daily range versus the middle US$ 7,000s range they were trading in just a week before. With owners still pushing to get rates above OPEX (operating costs) as soon as possible, charterers are putting up less resistance to any offers of upgraded rates. Indo rounds have been heard to be securing as much as US$ 12,000. Far East Handysize freights have been stable of late (unlike their Atlantic counterparts) with the southbound rates to Southeast Asia still circa US$ 10,500. For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

Far East Supramaxes launched a recovery of sorts in the final days of the week, leaving NoPac rounds as much as US$ 1,500 higher than they started the week and average rates (basis N.China delivery) in the middle US$ 8,000s daily range versus the middle US$ 7,000s range they were trading in just a week before. With owners still pushing to get rates above OPEX (operating costs) as soon as possible, charterers are putting up less resistance to any offers of upgraded rates. Indo rounds have been heard to be securing as much as US$ 12,000. Far East Handysize freights have been stable of late (unlike their Atlantic counterparts) with the southbound rates to Southeast Asia still circa US$ 10,500. For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

As predicted by BMTI at midweek, Capesize rates have, in fact, bounced back quite convincingly with a strong uptick in long haul rate levels in the Atlantic in particular. Trans-Atlantic RVs jump by as much as US$ 3,000 day-on-day to hit the mid-high teens of US$ 16-17,000 daily with talk of US$ 18-19,000 daily already being bandied about for the weekend. ECSA/UKC voyage freights are also up by nearly US$ 1/mt day-on-day with upwards of US$ 11.5/ mt now available on modern 180,000 dwt tonnage.

As predicted by BMTI at midweek, Capesize rates have, in fact, bounced back quite convincingly with a strong uptick in long haul rate levels in the Atlantic in particular. Trans-Atlantic RVs jump by as much as US$ 3,000 day-on-day to hit the mid-high teens of US$ 16-17,000 daily with talk of US$ 18-19,000 daily already being bandied about for the weekend. ECSA/UKC voyage freights are also up by nearly US$ 1/mt day-on-day with upwards of US$ 11.5/ mt now available on modern 180,000 dwt tonnage.

Fortunes have faded to a degree for the Capesize owners in the final days of October as the days get shorter and cargo demand gets a bit thinner on the ground. Certain brokers are predicting another surge of Atlantic demand in the coming days and there is reason to expect something similar in the Pacific, but for the moment the spot market is trending back toward charterer interests as avails start expanding. Brazil/UKC voyages are steady at US$ 12.3/mt.

Fortunes have faded to a degree for the Capesize owners in the final days of October as the days get shorter and cargo demand gets a bit thinner on the ground. Certain brokers are predicting another surge of Atlantic demand in the coming days and there is reason to expect something similar in the Pacific, but for the moment the spot market is trending back toward charterer interests as avails start expanding. Brazil/UKC voyages are steady at US$ 12.3/mt.

Expected yields for French soft wheat in the 2022/ 23 season have been lowered by French agency Agreste due to lower planting area. The agency lowered its forecast by 432,000mt this month to 33.69 Mt. High yields in the Hauts-de-France region have been offset by lower national crop area, down by 6% YoY.

Expected yields for French soft wheat in the 2022/ 23 season have been lowered by French agency Agreste due to lower planting area. The agency lowered its forecast by 432,000mt this month to 33.69 Mt. High yields in the Hauts-de-France region have been offset by lower national crop area, down by 6% YoY.

Winning Shipping made several moves this month as part of an ongoing fleet renewal including buying the 10-year-old, 180,000 dwt “Frontier Triumph” while selling both a post-Panamax and 21-year-old Capesize for scrap. The purchase and demolitions bring the Singapore-based owner’s fleet to 39 ships. Hamish Norton, president of bulker operator Star Bulk, said his company has “no plans” to order any new bulk carriers as long as the implementation of new environmental regulations such as the IMO’s upcoming EEXI and CII indices remains uncertain. Such orders, says Norton, may end up being “stranded assets” by 2030 as the ESG landscape will likely be quite different in a decade from now. Nasdaq-listed bulker companies had a bearish week with nearly every stock down. Eagle Bulk [EGLE] fell 9% to US$40.4, Golden Ocean [GOGL] lost 16% to US$ 7.3 and Diana [DSX] slid 22% to US$ 3.6. For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

Winning Shipping made several moves this month as part of an ongoing fleet renewal including buying the 10-year-old, 180,000 dwt “Frontier Triumph” while selling both a post-Panamax and 21-year-old Capesize for scrap. The purchase and demolitions bring the Singapore-based owner’s fleet to 39 ships. Hamish Norton, president of bulker operator Star Bulk, said his company has “no plans” to order any new bulk carriers as long as the implementation of new environmental regulations such as the IMO’s upcoming EEXI and CII indices remains uncertain. Such orders, says Norton, may end up being “stranded assets” by 2030 as the ESG landscape will likely be quite different in a decade from now. Nasdaq-listed bulker companies had a bearish week with nearly every stock down. Eagle Bulk [EGLE] fell 9% to US$40.4, Golden Ocean [GOGL] lost 16% to US$ 7.3 and Diana [DSX] slid 22% to US$ 3.6. For exclusive news and updates about dry bulk shipbroking, subscribe to the BMTI Daily Report.

As they sometimes do, Capesize rates are splitting into hemispheres with Pacific rates under pressure (possibly ahead of next week’s Golden Week) and Atlantic rates largely buoyant. Western buoyancy is being led by front haul demand with consecutive daily upgrades of around US$ 1,000 lifting rates (ex-UKC) from the middle US$ 30,000s to the high US$ 30,000s in just a few short days. Some shipowners already claim to be seeing rate offers for US$ 40,000 daily on modern tonnage based on US Gulf delivery.

As they sometimes do, Capesize rates are splitting into hemispheres with Pacific rates under pressure (possibly ahead of next week’s Golden Week) and Atlantic rates largely buoyant. Western buoyancy is being led by front haul demand with consecutive daily upgrades of around US$ 1,000 lifting rates (ex-UKC) from the middle US$ 30,000s to the high US$ 30,000s in just a few short days. Some shipowners already claim to be seeing rate offers for US$ 40,000 daily on modern tonnage based on US Gulf delivery.

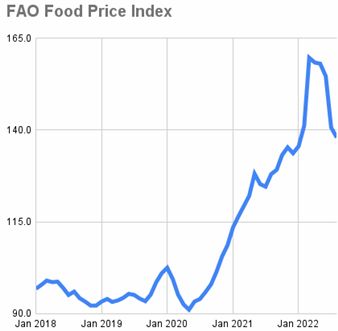

World food prices marginally declined for the fifth month in a row in August, based on the World Food Price Index created by the UN’s Food & Agriculture Organisation (FAO). Consumers have welcomed the easing in price inflation following the massive surge that happened immediately after the onset of war in Ukraine. Despite the decline, the UN hastened to add that food prices remain at historically high levels and that index values in the 140-160 range are still around 50% higher than the five-year-average when the index was consistently steady in the 90-100 range before the arrival of the Coronavirus pandemic in 2020. Average wheat prices, for example, are still some 10% higher than they were this time last year. The FAO also lowered its 2022 grain output forecast by 1.4%, citing heat waves in the EU among other global production limitations.

World food prices marginally declined for the fifth month in a row in August, based on the World Food Price Index created by the UN’s Food & Agriculture Organisation (FAO). Consumers have welcomed the easing in price inflation following the massive surge that happened immediately after the onset of war in Ukraine. Despite the decline, the UN hastened to add that food prices remain at historically high levels and that index values in the 140-160 range are still around 50% higher than the five-year-average when the index was consistently steady in the 90-100 range before the arrival of the Coronavirus pandemic in 2020. Average wheat prices, for example, are still some 10% higher than they were this time last year. The FAO also lowered its 2022 grain output forecast by 1.4%, citing heat waves in the EU among other global production limitations.

Having fallen to their lowest level since February, Capesize rates were in the doldrums until the start of this week when a recovery in sentiment saw most levels starting to bounce back by midweek. The rally is most pronounced in the Pacific, where RV rates have swiftly climbed from the US$ 6,000s into the US$ 8-9,000s in just 48 hours. The reduction in congestion levels in the month of August has had a positive impact on returning charterers to the spot market, which shipowners hope will stay a virtuous cycle going into the end of the month. Brokers report that BHP has suddenly found themselves facing a challenge in finding or fixing any ships ETA Port Hedland as few owners have been willing to agree to index rates, a bullish indication to be sure.

Having fallen to their lowest level since February, Capesize rates were in the doldrums until the start of this week when a recovery in sentiment saw most levels starting to bounce back by midweek. The rally is most pronounced in the Pacific, where RV rates have swiftly climbed from the US$ 6,000s into the US$ 8-9,000s in just 48 hours. The reduction in congestion levels in the month of August has had a positive impact on returning charterers to the spot market, which shipowners hope will stay a virtuous cycle going into the end of the month. Brokers report that BHP has suddenly found themselves facing a challenge in finding or fixing any ships ETA Port Hedland as few owners have been willing to agree to index rates, a bullish indication to be sure.