Freights are climbing again in the southern European trades to the delight of owners working in the area and running against the prevailing summer holidays of northern Europe. Freights for grain ex-Rostov to Marmara are up to US$ 26/mt while grain ex-Rostov to the Egyptian Med is up to US$ 42-43/mt, depending on terms (basis grain of 5,000mt). Owners are seeking higher rates on grains from Danube River ports as well with grain cargoes from Reni now fetching US$ 17/mt and even US$ 18/mt to the Sea of Marmara (stowage of 53′) on 5,000mt. Grain ex-Reni to the Italian Adriatic has been fetching rates of US$ 26/mt, brokers report. Danube freights are nonetheless far below their levels of one year ago, owners note, when Reni/Marmara trades were up to US$ 42/mt (now securing less than half of this).

Subscribe to the BMTI Short Sea Report today for exclusive news on the European Short Sea markets.

Even with the stabilizing trends of early July having comforted owners about their summer prospects, overall cargo demand continues to wane inexorably across the European coaster trades. Week-on-week discounts have been manageable, but they are discounts nonetheless and owners could be dealing with some serious cumulative discounts by the time holiday season is through. Northbound trips from the North of Spain to Ireland are still fetching middle EUR 20s/mt of EUR 25/mt, depending on terms, though charterers have been having some success in slowly moving that range downward over the course of the month so far. Southbound trips remain comparatively more lucrative with talk of EUR 50s/mt still being fixed on the more urgent trades from SCUK to the Turkish Med. Other sources say high EUR 40s/mt are the best that an owner could hope for on this run in the current spot market. Steady-to-slumping bunker prices have not given owners any leverage in negotiations either, leaving them with little recourse but to take what the charterers are offering.

Even with the stabilizing trends of early July having comforted owners about their summer prospects, overall cargo demand continues to wane inexorably across the European coaster trades. Week-on-week discounts have been manageable, but they are discounts nonetheless and owners could be dealing with some serious cumulative discounts by the time holiday season is through. Northbound trips from the North of Spain to Ireland are still fetching middle EUR 20s/mt of EUR 25/mt, depending on terms, though charterers have been having some success in slowly moving that range downward over the course of the month so far. Southbound trips remain comparatively more lucrative with talk of EUR 50s/mt still being fixed on the more urgent trades from SCUK to the Turkish Med. Other sources say high EUR 40s/mt are the best that an owner could hope for on this run in the current spot market. Steady-to-slumping bunker prices have not given owners any leverage in negotiations either, leaving them with little recourse but to take what the charterers are offering. The chartering market within the Atlantic remains a mixed bag of opportunities. Baltic-Black Sea range not overly amusing whilst USG-W.Africa and, obviously, the ECSA seem the better areas to be, though a softening trend seems slowly becoming more evident. Off the Continent, Supra chars were shrugging their shoulders when they were seeing tonnage at US$ 25,000 for a quick eight-day employment from GNS to the Netherlands, for which trade realistic owns were coming up with US$ 12,500 daily. Scrap charterers were discussing 58,000 dwt at US$ 10-11,000 daily for a trip from GNS to eastern Med. Steel charterers were rating 53,000 dwt tonnage at US$ 11,000 daily for a trip to USEC. Considering this, dropping a Supramax on subs at US$ 14,500 daily for similar is only logical. Trips with clinker from the West Mediterranean to West Africa are down to US$ 13,500 daily on Ultramax tonnage.

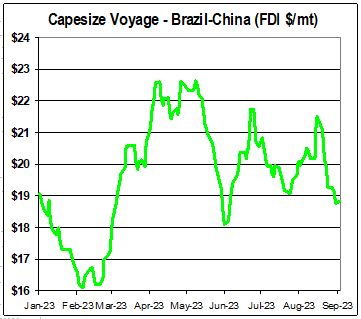

The chartering market within the Atlantic remains a mixed bag of opportunities. Baltic-Black Sea range not overly amusing whilst USG-W.Africa and, obviously, the ECSA seem the better areas to be, though a softening trend seems slowly becoming more evident. Off the Continent, Supra chars were shrugging their shoulders when they were seeing tonnage at US$ 25,000 for a quick eight-day employment from GNS to the Netherlands, for which trade realistic owns were coming up with US$ 12,500 daily. Scrap charterers were discussing 58,000 dwt at US$ 10-11,000 daily for a trip from GNS to eastern Med. Steel charterers were rating 53,000 dwt tonnage at US$ 11,000 daily for a trip to USEC. Considering this, dropping a Supramax on subs at US$ 14,500 daily for similar is only logical. Trips with clinker from the West Mediterranean to West Africa are down to US$ 13,500 daily on Ultramax tonnage.  Capesize

Capesize Warmer conditions in the last two weeks of May helped alleviate some of the wet conditions that were plaguing French

Warmer conditions in the last two weeks of May helped alleviate some of the wet conditions that were plaguing French  No safety net is evident for the

No safety net is evident for the

Eastern

Eastern  The holding pattern continues for

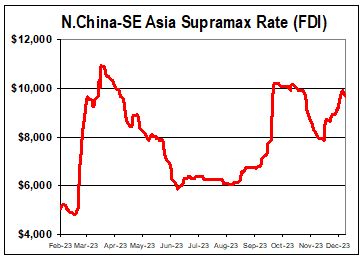

The holding pattern continues for  Pressure has been notable on Supramax spot freights over the past week even as trends have not been as uniformly deflationary as in other markets with average inter-Pacific rates losing around US$ 500 week-on-week. Current NoPac rounds for 58,000 dwt ships, for instance, are now trading within the high US$ 10,000s daily range in contrast to the lower US$ 11,000s as seen a week earlier during the most recent course correction. Short period deals on Ultramax vessels are still looking rather robust with 3-5 months being secured in excess of US$ 16,500 daily.

Pressure has been notable on Supramax spot freights over the past week even as trends have not been as uniformly deflationary as in other markets with average inter-Pacific rates losing around US$ 500 week-on-week. Current NoPac rounds for 58,000 dwt ships, for instance, are now trading within the high US$ 10,000s daily range in contrast to the lower US$ 11,000s as seen a week earlier during the most recent course correction. Short period deals on Ultramax vessels are still looking rather robust with 3-5 months being secured in excess of US$ 16,500 daily. With the ever-important holiday period bearing down in the next few weeks, traders, owners and charterers alike are all looking at the writing on the wall, hoping to put in their last-minute year-ending requirements at the best possible profit. As such, market fundamentals remain locked into a largely sideways path even as there are no longer signs of bunker prices rising enough to push operating costs any higher than they were at the start of the month. Northbound trips are still fetching rates just below €50/mt from the Spanish Med into the North Sea with some reports of rates even exceeding €50/mt on redelivery Ireland. Southbound freights from Ireland into the lower Baltic are securing rates in the middle-high €20s/mt with at least one owner claiming to have fixed €30/mt on this business with agri-prods of 5,000mt (46′). Charterers are said to be behaving slightly more accommodating for fixing urgent business on Baltic delivery with the BMTI benchmark rates from the Baltic States to ARAG seen pushing slightly higher into the mid-high €20s/mt range and talk of €27-28/mt being done on some cargoes ex-Klaipeda even if the prevailing rates are still largely in the vicinity of €26/mt on this run. Stormy weather rolling across the North Sea and northern Continent is said to be getting even worse, which has driven a number of delays and cancellations, which are in turn impinging on overall tonnage availability, ultimately propping up freights by an uncertain degree.

With the ever-important holiday period bearing down in the next few weeks, traders, owners and charterers alike are all looking at the writing on the wall, hoping to put in their last-minute year-ending requirements at the best possible profit. As such, market fundamentals remain locked into a largely sideways path even as there are no longer signs of bunker prices rising enough to push operating costs any higher than they were at the start of the month. Northbound trips are still fetching rates just below €50/mt from the Spanish Med into the North Sea with some reports of rates even exceeding €50/mt on redelivery Ireland. Southbound freights from Ireland into the lower Baltic are securing rates in the middle-high €20s/mt with at least one owner claiming to have fixed €30/mt on this business with agri-prods of 5,000mt (46′). Charterers are said to be behaving slightly more accommodating for fixing urgent business on Baltic delivery with the BMTI benchmark rates from the Baltic States to ARAG seen pushing slightly higher into the mid-high €20s/mt range and talk of €27-28/mt being done on some cargoes ex-Klaipeda even if the prevailing rates are still largely in the vicinity of €26/mt on this run. Stormy weather rolling across the North Sea and northern Continent is said to be getting even worse, which has driven a number of delays and cancellations, which are in turn impinging on overall tonnage availability, ultimately propping up freights by an uncertain degree. After ending last week on a bit of a down note,

After ending last week on a bit of a down note,  The Pacific Supramax freights have remained largely buoyant over the past week with average rates for NoPac rounds gaining some US$ 750-1,000 week-on-week to settle at rates of around US$ 10,500 with reports of as much as US$ 11,000 in negotiations in tonnage of 58,000 dwt. Indeed, backhaul rates have already been reported at this level on Ultramaxes ex-ECI back to the Continent. Indonesia rounds are also climbing back quickly compared to weeks past with upwards of US$ 14,500 daily not available on tonnage of 58,000 dwt (ex-WCI) and as much as US$ 16,000 on tonnage of 62,000 dwt. Unlike the larger Supras and Ultras, eastern Handysize rates have not increased noticeably over the past week, although they have not decreased either. This stability is what owners have come to expect and last few days have born that out. N.China delivery of 38-42,000 dwt tonnage to CJK or S.Korea is about as likely to secure about US$ 10,250 daily as it was a week earlier. Steel cargoes are being shipped on tonnage of 42,000 dwt ex-S.China to the UKC-Med at up to US$ 13,000, brokers say. Trips from the Singapore-Japan area to Southeast Asia on standard Handy tonnage are fetching mid US$ 9,000s.

The Pacific Supramax freights have remained largely buoyant over the past week with average rates for NoPac rounds gaining some US$ 750-1,000 week-on-week to settle at rates of around US$ 10,500 with reports of as much as US$ 11,000 in negotiations in tonnage of 58,000 dwt. Indeed, backhaul rates have already been reported at this level on Ultramaxes ex-ECI back to the Continent. Indonesia rounds are also climbing back quickly compared to weeks past with upwards of US$ 14,500 daily not available on tonnage of 58,000 dwt (ex-WCI) and as much as US$ 16,000 on tonnage of 62,000 dwt. Unlike the larger Supras and Ultras, eastern Handysize rates have not increased noticeably over the past week, although they have not decreased either. This stability is what owners have come to expect and last few days have born that out. N.China delivery of 38-42,000 dwt tonnage to CJK or S.Korea is about as likely to secure about US$ 10,250 daily as it was a week earlier. Steel cargoes are being shipped on tonnage of 42,000 dwt ex-S.China to the UKC-Med at up to US$ 13,000, brokers say. Trips from the Singapore-Japan area to Southeast Asia on standard Handy tonnage are fetching mid US$ 9,000s.