On 3 February 1637, at a Dutch auction, not enough buyers of tulip bulbs were found and the tulip bubble burst. Many speculators and investors lost all of their belongings.

Since the 16th century, tulip bulbs from Armenia and Turkey have been imported to Europe. First, the tulips were sold at reasonable prices. After new varieties were bred, a true tulip mania began. The demand was huge, but it took a long time to grow the tulips. Thus, a low supply was offset by a great demand.

People, rich and poor, entered the business with the popular plant. Most of them had no interest in gardening, but only in the trade of the flower. Knowledge of horticulture was not necessary anyway, since one could turn to intermediaries who only demanded start-up capital.

Holland at that time was a world power, attracting much gold and silver that was shipped into the country. Thus, existing goods faced more money (inflation) and prices rose. This presented the basic conditions for the emergence of a tulip bubble.

Around 1623, the rare tulip variety Semper Augustus came to the Netherlands. One of them cost 1,000 guilders, which was about six years’ income for a worker. Other varieties were later even traded for up to 10,000 guilders. At the time, this was the equivalent of a house in Amsterdam. However, the plants were not traded on the Amsterdam stock exchange, but rather in so-called taverns, where auctions were carried out.

But one day, on February 3, 1637, there were not enough buyers at one of the auctions: the tulip bubble burst. In the following months, prices for the former prestige object collapsed by 99%. Speculators went broke in droves.

Representatives of Dutch cities came together at the end of February to set up commissions. They laid down the rule that open futures contracts could be paid off by a penalty of 3.5% of the purchase price. This was paid by the growers and thereby the commissions wanted to prevent a spread of the distortions to other sectors of the economy.

This tulip bubble is considered the first well-documented speculative bubble in economic history

To get exclusive and intelligent shipbroking analysis like this each and every morning, simply subscribe to the BMTI Daily Report.

Adriatic Sea market:

Adriatic Sea market:  The holidays have continued to linger into 2020 with principals seemingly in no major rush to secure business as long as they can afford to push their requirements down the road. The unexpectedly high momentum that continued into early December and buoyed coaster markets across Europe (from north to south), remains technically in place as far as market fundamentals go, but spot freight trends are looking to move sideways at best into January with charterers expected to start applying more pressure as the month progresses. Owners remain hopeful, however, that adverse weather and their connected delays—as well as the relatively tight tonnage situation of Q4-2019—will keep things moving in their favour for at least another few weeks, but time shall tell if Baltic markets break out of their traditional cycle and do not, in fact, start to slide in January as expected. Northbound freights from the Baltic States to Ireland are fetching decent rates of EUR 30/mt, brokers say, while southbound freights from ARAG (with 5,000mt general cargoes) are securing even better rates of EUR 37-38/mt and higher. There is word, however, that charterers have already secured discounts on those levels for end-month positions.

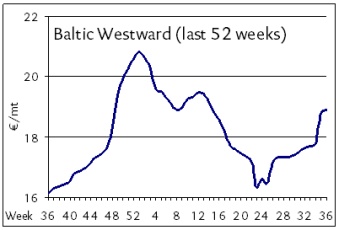

The holidays have continued to linger into 2020 with principals seemingly in no major rush to secure business as long as they can afford to push their requirements down the road. The unexpectedly high momentum that continued into early December and buoyed coaster markets across Europe (from north to south), remains technically in place as far as market fundamentals go, but spot freight trends are looking to move sideways at best into January with charterers expected to start applying more pressure as the month progresses. Owners remain hopeful, however, that adverse weather and their connected delays—as well as the relatively tight tonnage situation of Q4-2019—will keep things moving in their favour for at least another few weeks, but time shall tell if Baltic markets break out of their traditional cycle and do not, in fact, start to slide in January as expected. Northbound freights from the Baltic States to Ireland are fetching decent rates of EUR 30/mt, brokers say, while southbound freights from ARAG (with 5,000mt general cargoes) are securing even better rates of EUR 37-38/mt and higher. There is word, however, that charterers have already secured discounts on those levels for end-month positions. [28 NOV 2019] Capital markets have not been overly enthusiastic about shipping in recent years, this past year being no exception, but, according to more than a few finance professionals, this is prime time for a turnaround in fortunes with smart money poised to see solid returns. This is also the opinion of Erik Helberg, CEO of Clarksons Platou Securities, who held a convincing presentation in Hamburg at the 23rd annual

[28 NOV 2019] Capital markets have not been overly enthusiastic about shipping in recent years, this past year being no exception, but, according to more than a few finance professionals, this is prime time for a turnaround in fortunes with smart money poised to see solid returns. This is also the opinion of Erik Helberg, CEO of Clarksons Platou Securities, who held a convincing presentation in Hamburg at the 23rd annual

General sentiment continues to be buoyed by the ongoing grain season activities in the northern European coaster markets with new shipments entering the Baltic from Germany, Scandinavia and the Baltic States, among others. Rates have been slowly but steadily edging upward on last-done, but very slowly with some shipowners reporting week-on-week premiums of up to EUR 0.50/mt but more upgrades proving to be closer to EUR 0.25/mt if anything at all. The firming pace of activity is nonetheless expected to make September a better month than August was with hopes high across the North Sea and the Baltic Sea. Inter-Baltic trips from Norway with minor split cargoes of 3,000mt to the German Baltic continue to trade at unspectacular rates in the single digits of EUR 6-8/mt, depending on terms.

General sentiment continues to be buoyed by the ongoing grain season activities in the northern European coaster markets with new shipments entering the Baltic from Germany, Scandinavia and the Baltic States, among others. Rates have been slowly but steadily edging upward on last-done, but very slowly with some shipowners reporting week-on-week premiums of up to EUR 0.50/mt but more upgrades proving to be closer to EUR 0.25/mt if anything at all. The firming pace of activity is nonetheless expected to make September a better month than August was with hopes high across the North Sea and the Baltic Sea. Inter-Baltic trips from Norway with minor split cargoes of 3,000mt to the German Baltic continue to trade at unspectacular rates in the single digits of EUR 6-8/mt, depending on terms.