With markets in flux, resource prices shifting and sentiment turning around among the biggest bulkers, there is reason to expect a robust recovery in Capesize rates. On the other hand, we’ve been here before and rather few are convinced that any sustainable rebound is behind the current bounce. Nonetheless, day-on-day gains of US$ 1,000 across the board are injecting the market with a sense of optimism as TARVs move toward US$ 21,000 daily. Period deals have been getting fixed in the low US$ 20,000s with at least one medium period deal having exceeded US$ 23,000 daily on a 180,000 dwt.

Tentatively, Panamaxes start the week with freights ever so vaguely trending in owners’ favour even as it remains exceedingly clear that markets are still rather indecisive as to where rates will go in July. Business activity is higher than it has been for some time, at any rate, especially for the start of the week, so this was taken as a positive sign by the more optimistic owners. Period business, as with Capes, has accelerated of late with short periods at US$ 13,000 plus.

There are mixed reports from the Black Sea about Handy bulk business, but we are hearing from some traders that front haul trips are poised for improvement as freights of US$ 15,000 daily move into the US$ 16,000s for middle-July dates. The Atlantic is nevertheless rather calm if compared to its eastern counterpart as Southeast Asia starts showing signs of recovery with handful of northbound trips in the US$ 11,000s daily on modern Ultramax tonnage.

Want to read our shipbroker viewpoint fresh each morning?

Subscribe to the BMTI DAILY REPORT today.

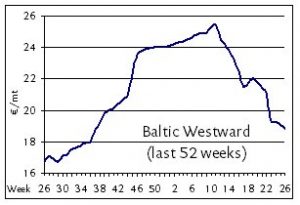

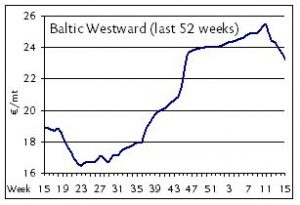

[27 JUNE 2018] With both European holidays and sluggish summer industrial trends setting in, pressure continues to grow on rates in the northern short sea markets even as owners manage to keep discounts limited. Operating costs, as always the basement level for rates to fall, have themselves taken a hit in recent weeks with bunker prices having progressively fallen, giving owners one fewer negotiating tool in keeping rates steady, if not higher. Freights in the high teens of EUR 17-18/mt on the Baltic westward routes from Balticum to ARAG (based on 3,000mt general cargo parcels) have moved slowly but surely into the mid teens of EUR 15-16/mt on the same run, brokers report. ECUK cargoes of 5,000mt are still securing around EUR 10-12/mt, depending on terms, to ARAG. Southbound spot freights remain relatively more attractive as southern European trade regions continue to attract higher activity and firmer rates than their northern counterparts. Agri-prods with stowage of 44-48′ are seen fetching EUR 24-26/mt, traders report, on business from the Upper Baltic to the French Mediterranean, more or less unchanged from rates on the same run since late May. Similar rates are reported as concluded on WCUK/Marmara business. Northbound rates from the Spanish Med to ARAG are fetching high teens of EUR 16-18/mt on mid-size parcels of 5,000mt while the same to the Upper Baltic is getting as high as EUR 22/mt. Upper Baltic to Ireland is still in the lower EUR 20s/mt, we are told, with owners keeping charterers at bay with EUR 21/mt as the lowest offer accepted.

[27 JUNE 2018] With both European holidays and sluggish summer industrial trends setting in, pressure continues to grow on rates in the northern short sea markets even as owners manage to keep discounts limited. Operating costs, as always the basement level for rates to fall, have themselves taken a hit in recent weeks with bunker prices having progressively fallen, giving owners one fewer negotiating tool in keeping rates steady, if not higher. Freights in the high teens of EUR 17-18/mt on the Baltic westward routes from Balticum to ARAG (based on 3,000mt general cargo parcels) have moved slowly but surely into the mid teens of EUR 15-16/mt on the same run, brokers report. ECUK cargoes of 5,000mt are still securing around EUR 10-12/mt, depending on terms, to ARAG. Southbound spot freights remain relatively more attractive as southern European trade regions continue to attract higher activity and firmer rates than their northern counterparts. Agri-prods with stowage of 44-48′ are seen fetching EUR 24-26/mt, traders report, on business from the Upper Baltic to the French Mediterranean, more or less unchanged from rates on the same run since late May. Similar rates are reported as concluded on WCUK/Marmara business. Northbound rates from the Spanish Med to ARAG are fetching high teens of EUR 16-18/mt on mid-size parcels of 5,000mt while the same to the Upper Baltic is getting as high as EUR 22/mt. Upper Baltic to Ireland is still in the lower EUR 20s/mt, we are told, with owners keeping charterers at bay with EUR 21/mt as the lowest offer accepted. The holiday hangover has lingered over the

The holiday hangover has lingered over the  Losses have been rather substantial in the eastern Handy bulk trades in the past week as the monthly switchover and widespread holidays gave charterers all the excuse they needed to get rates reduced toward their preferences. In the event, Supra NoPac rounds lost US$ 500 week-on-week to settle in the lower US$ 11,000s after trading high US$ 11,000s just a week earlier. Indonesia rounds, meanwhile, shed some US$ 300-500 over the week, putting the South China delivery and redelivery round in the high US$ 10,000s of about US$ 10,750 daily on tonnage of 58,000 dwt. Period chartering has been done, though intermittently, with short periods of six months getting US$ 13,000 daily on Handymax tonnage of 54-56,000 dwt from Southeast Asia.

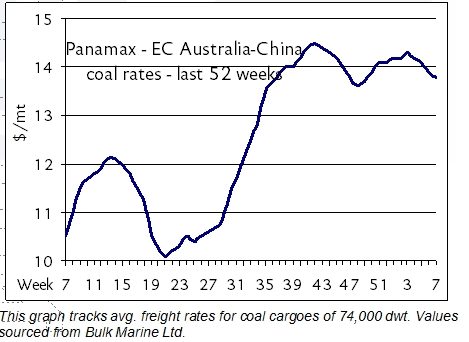

Losses have been rather substantial in the eastern Handy bulk trades in the past week as the monthly switchover and widespread holidays gave charterers all the excuse they needed to get rates reduced toward their preferences. In the event, Supra NoPac rounds lost US$ 500 week-on-week to settle in the lower US$ 11,000s after trading high US$ 11,000s just a week earlier. Indonesia rounds, meanwhile, shed some US$ 300-500 over the week, putting the South China delivery and redelivery round in the high US$ 10,000s of about US$ 10,750 daily on tonnage of 58,000 dwt. Period chartering has been done, though intermittently, with short periods of six months getting US$ 13,000 daily on Handymax tonnage of 54-56,000 dwt from Southeast Asia. The Panamax freight rates since last week are on the start to continue on their southbound trail but with low demand of grains from Chinese buyers.

The Panamax freight rates since last week are on the start to continue on their southbound trail but with low demand of grains from Chinese buyers.

Slowly but surely activity has been creeping up in the eastern basin in recent days with owners seeing more room for securing better rates even as prevailing trends remain flat. Indonesia-based business has also gained momentum with S. China delivery to ECI now getting middle US$ 8,000s via Indonesia instead of the low US$ 8,000s range typical a week earlier. Rates for NoPac rounds have not changed significantly since the year began with owners still settling for just over US$ 8,000 in most cases. Back haul rates to the Continent are set to start increasing. Brokers report that Handysizes have been seeing more enquiry of late, which comes as some encouragement for owners who nonetheless have been settling for last-done rates since the start of the year. SE Asia trips to NoPac via W. Australia have been fixed up to US$ 7,500 daily on 28,000 dwt ships, owners say, with some seeking US$7,750. A 32,000 dwt vessel has done US$ 8,250 ex-CJK to N.China.

Slowly but surely activity has been creeping up in the eastern basin in recent days with owners seeing more room for securing better rates even as prevailing trends remain flat. Indonesia-based business has also gained momentum with S. China delivery to ECI now getting middle US$ 8,000s via Indonesia instead of the low US$ 8,000s range typical a week earlier. Rates for NoPac rounds have not changed significantly since the year began with owners still settling for just over US$ 8,000 in most cases. Back haul rates to the Continent are set to start increasing. Brokers report that Handysizes have been seeing more enquiry of late, which comes as some encouragement for owners who nonetheless have been settling for last-done rates since the start of the year. SE Asia trips to NoPac via W. Australia have been fixed up to US$ 7,500 daily on 28,000 dwt ships, owners say, with some seeking US$7,750. A 32,000 dwt vessel has done US$ 8,250 ex-CJK to N.China. Considerably more

Considerably more