Through all the ups and downs and inter-week volatility, it seems that Capesize freights have finally climbed to new year-to-date highs, proving that the bullishness is hardly a temporary fluke but rather a underlying feature of a newly confident spot market. With China/Brazil RVs reaching US$ 23,000 daily, the highest level this year so far, and the equivalent voyages hitting similar highs of US$ 22.6/mt, this summer is shaping up to be a very generous one for the biggest bulkers. Pacific rounds have seen even stronger improvements of US$ 1,000 at midweek, taking the assessment into the US$ 22-23,000 daily range and giving shipowners cause for celebration.

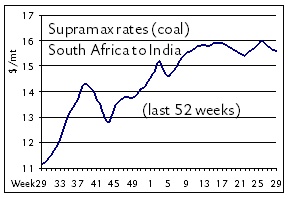

Even as the Pacific Panamaxes lag behind, improvements have been strong enough in the West to add to the BPI reaching its highest level in four months and owners looking for upgrades where they would not have dared just two weeks ago. Robust demand for coal to India, in the midst of monsoon season no less, has contributed to tightening tonnage in the Indian Ocean even as it hasn’t been enough to close the gap on available tonnage yet and drive rates upward. Indo rounds are still fetching US$ 11-12,000 daily on HK delivery to ECI on Kamsarmax tonnage.

Handysizes have been rebounding in the Atlantic basin with average trans-Atlantic freights on 28,000 dwt tonnage reaching the five-digit range of the low-middle US$ 10,000s on ECSA trips to the Continent and up to US$ 12,000 on the same run with 38-42,000 dwt vessels. Handysizes from the USG have been securing high US$9,000s on NCSA redel while the rest of the Atlantic is more hit or miss. Front hauls ex-Black Sea to the Far East have revived of late with US$ 18,500 daily now doable on a Tess 58.

Would you like to read our shipbroker viewpoint every morning?

Subscribe to the BMTI DAILY REPORT today.