The chartering market is looking very promising which many players are confident will last for the remainder of this year. Panamaxes are dominating with charterers struggling to find them. Sentiment from the Continent remains largely bullish. Tonnage of 38,000 dwt was fixed to Brazil at US$ 15,250 per day with delivery Norway. Rates from North France to the West Mediterranean on 33,000 dwt tonnage have risen to US$ 16,000 daily, which is catapulting the Rouen/Algeria voyage to around US$ 24/mt. And for a trip to the Far East with delivery in the Baltic, charterers are bidding a 27,000 dwt US$ 18,000 daily. British Steel took a 35,000 dwt from St. Lawrence via Narvik to the Continent at US$ 11,000, which is a fixture that is self-explanatory of the dire situation facing charterers in the North Atlantic.

European wheat prices appear to be firming on the back of a softer euro and renewed optimism for the EU wheat crop. Paris prices rose by EUR 0.5/mt at the end of last week to EUR 173.25/mt for December milling wheat contracts after reaching a contract low at the start of the week some EUR 3/mt lower. The euro, however, has been falling since the start of August, making euro-denominated wheat more attractive for dollar buyers on the global marketplace. Analysts including Strategie Grains have responded to the turnaround by upgrading their export forecasts for EU soft wheat in the present season. Fresh optimism about the German wheat harvest, albeit delayed by recent rainfall, has driven new sales in the domestic market with some traders claiming that as much as 0.25 Mt has already been purchased from this season’s new German crop. More than 90% of the current German wheat crop has already been harvested, making sales activity less vulnerable to shifting weather conditions going forward.

Corrections have been coming fast and hard on the Capesize long hauls with Pac RVs losing nearly US$ 1,500 on Tuesday to hit US$ 26,000 and TARVs settling at just above US$ 30,000. One very notable exception, however, is the front haul market, which appears to have been energized by another round of cargo demand, driving it about US$ 2,000 upward on the Continental delivery to exceed a freight of US$ 52,000 daily on the 180,000 dwt assessment.

Panamax rates haven’t entered an all-out collapse—far from it—but the once flat and steady trans-Atlantic round voyage rates have buckled under the pressure of reversing sentiment and sliding cargo demand to slide into the high US$ 19,000s daily on UKC delivery. Pacific-based business is so far proving to be far more stable with drops still negligible as owners stay hopeful cargoes will be strong enough to keep freight rates from falling from current levels.

Stock markets fell sharply this week—the second biggest drop all year—on ongoing trade war worries and news from Germany and China indicating slower economic growth. Bond prices rose sharply, pushing yields to multi-year lows, analysts said. The S&P on Wall Street fell 2.93% on Wednesday, pressured by declines in the energy sector. Japan’s Nikkei exchange dropped 1.3%, though eastern stock markets were relatively stable compared to western ones. European stock markets declined across the board after the German government reported that the German economy shrank over the second quarter of the year, the second negative quarter in a row, indicating that the eurozone’s biggest economy was in recession according to the widely accepted economic definition of recession. Germany, which remains a highly export-dependent economy, has been especially affected by the ongoing US-China trade war.

On 3 February 1637, at a Dutch auction, not enough buyers of tulip bulbs were found and the tulip bubble burst. Many speculators and investors lost all of their belongings.

Since the 16th century, tulip bulbs from Armenia and Turkey have been imported to Europe. First, the tulips were sold at reasonable prices. After new varieties were bred, a true tulip mania began. The demand was huge, but it took a long time to grow the tulips. Thus, a low supply was offset by a great demand.

People, rich and poor, entered the business with the popular plant. Most of them had no interest in gardening, but only in the trade of the flower. Knowledge of horticulture was not necessary anyway, since one could turn to intermediaries who only demanded start-up capital.

Holland at that time was a world power, attracting much gold and silver that was shipped into the country. Thus, existing goods faced more money (inflation) and prices rose. This presented the basic conditions for the emergence of a tulip bubble.

Around 1623, the rare tulip variety Semper Augustus came to the Netherlands. One of them cost 1,000 guilders, which was about six years’ income for a worker. Other varieties were later even traded for up to 10,000 guilders. At the time, this was the equivalent of a house in Amsterdam. However, the plants were not traded on the Amsterdam stock exchange, but rather in so-called taverns, where auctions were carried out.

But one day, on February 3, 1637, there were not enough buyers at one of the auctions: the tulip bubble burst. In the following months, prices for the former prestige object collapsed by 99%. Speculators went broke in droves.

Representatives of Dutch cities came together at the end of February to set up commissions. They laid down the rule that open futures contracts could be paid off by a penalty of 3.5% of the purchase price. This was paid by the growers and thereby the commissions wanted to prevent a spread of the distortions to other sectors of the economy.

This tulip bubble is considered the first well-documented speculative bubble in economic history

To get exclusive and intelligent shipbroking analysis like this each and every morning, simply subscribe to the BMTI Daily Report.

Despite anticipating a correction after the run-up of mid-summer, Azov owners say they were nonetheless caught off guard by the magnitude of the crash in rates seen in the past two weeks, taking an even more extreme turn in the past week, which saw rates fall by some US$ 4-5/mt week-on-week and sometimes as much as US$6/mt. Average grain rates for Azov/Marmara are reported at US$ 23/mt or some US$ 3-4/mt lower than a week before, while grain rates for 5,000mt (46′) ex-Rostov to Marmara have been trading as low as US$ 19-20/mt, representing losses of US$ 6/mt in just the transition between months. The upcoming Bayram holidays in Turkey and across the Black Sea in the Muslim world is not likely to help sentiment as owners prepare for an upcoming period of bearish sentiment and rate reversals. Black Sea rates have been somewhat steadier by comparison with the Kherson/Marmara rates holding to mid teens of US$ 16/mt or thereabouts.

Get weekly updates from all the European short sea markets by subscribing to the BMTI SHORT SEA REPORT today.

Exports of steel from Turkey surged 30% year-on-year in May to 2.1 Mt, based on new data from the Turkish Steel Producers’ Association. Domestic output fell by 8% nonetheless to 3.1 Mt in the month due primarily to weaker domestic demand even as international demand for Turkish steel continued to grow. In the year through May, steel shipments from Turkey jumped by 20% in the five-month period to 9.8 Mt. The US deciding to reduce tariffs on Turkish steel exports also spurred demand for steel exports to the US, one of Turkey’s major Atlantic buyers.

A combination of lower output forecasts in the EU, Russia and Canada has prompted the International Grains Council to reduce its newest projection for world wheat production in the 2019-2020 season. IGC now expects to see 763Mt in wheat produced in the current season, 6 Mt less than its previous prediction. While it kept its forecast for US output flat at 333.5 Mt, IGC lowered predictions for Russian output to 75.7 Mt (down from 79.5 Mt), EU output to 148.7 Mt (down from 151.2 Mt) and Canadian output to 32 Mt (from a previous 33.6 Mt). The EU itself recently downgraded its in-house forecast for wheat production to 141.3 Mt, slightly lower than the 142.3 Mt prediction it had the month before.

Following last week’s description of shipping finance in eighteenth century Greece:

Shares versus Loans

The loan carried a yearly interest rate of about 30% and was to be repaid provided the vessel was not lost. The shareholders’ pay-off depended on the profit remaining after the payment of interest and other expenses. Half of the profit would go to the crew (no fixed wages were paid) and the other half to the shareholders. The shareholders’ income would thus depend on the charter rates the vessel would get. And thus their participation was riskier than a straightforward loan, whose return would be independent of the charter rates. Some investors, usually the wealthier ones, were willing to undertake these risks to their entirety while others wanted to reduce it. Thus, if an investor entered 50% of his funds in the vessel and the rest in a loan, he was better off in case the return on the vessel was below 30% and worse off otherwise. This reduced the variation of the investment return. The high interest rates for the loans were due to the high dangers at sea. At the end of the eighteenth century, a ship loss in the eastern Mediterranean Sea was calculated to be about 15-20% so the average vessel age was in a range of 5-7 years.

Developing Situation

The situation changed with the increased investment required for a steamer ship. The necessary capital could no longer be raised nearby and the merchants resorted to the London capital market or other financial centres. In the beginning of the steamship era, the captains did not have a controlling interest but as their know-how for running steamships increased, several captains bought out the other partners and became controlling owners. This structure of a shipping firm is the norm in contemporary shipping where every vessel is a separate company with a leading partner, several other partners and considerable bank financing. Of course, shipping loans today are not written off in case the ship is lost, and the development of the specialized insurance market has fundamentally changed the nature of risk into a financial factor rather than a physical one.

But in general, it can be stated that from the beginning of financing on all parties involved (merchant-owners, investors, accountants and notaries) indirectly show an understanding of the risk return tradeoffs and try, through several financing alternatives, to apportion the risks in an equitable way

To get exclusive and intelligent shipbroking analysis like this each and every morning, simply subscribe to the BMTI Daily Report.

As almost anticipated the Capesizes have turned negative, with the TCA down by 885 to 32,078. All routes declined with the trans-Pacific rounds losing most with more than US$ 1,000 and hardly be able to reach the US$ 30,000 daily mark. Even the wild card, the Brazilian to China voyages are sliding and have dropped already more than US$ 1/mt from the peak seen recently.

For the Panamaxes the amount of fresh enquiries has slowed down a bit although the spot freight rates continue to increase. Ore shipments from Northern Australia keep coming at spot freight rates in the high US$ 15,000s daily on 90,000dwt tonnage towards Singapore-Japan range. Trans-Atlantic rounds can be quoted for young tonnage of 80-2,000 dwt at some US$ 23,000 per day.

Business is not very abundant for the smaller sizes at the moment but coming steady into the market. Young Tess 58 tonnage is talked in a range of US$ 10,000 daily for a trans-Atlantic round trip when open mid China. Indonesian rounds can be quoted at a similar level on same tonnage with delivery in Southern China. Fertilizer shipments of 60-65,000mt can see rates of some US$ 42-44/mt loading US Gulf and redelivery WC India compared to about US$ 38-40/mt seen before. Handies of 28-30,000dwt are rated in a range of US$ 7-7,250 daily for a trip from EC India and redelivery SE Asia.

To get exclusive and intelligent shipbroking analysis like this each and every morning, simply subscribe to the BMTI Daily Report.

Although centuries of merchant shipping have passed, the kind of financing of ships in general has been the same throughout the years. There exist two possibilities: (1) a merchant has enough capital to buy and maintain a ship or (2) a ship is financed through the sale of shares and borrowing to a number of investors willing to participate in the enterprise. Since early times, for this kind of financing it was normal that only a certain amount of money truly existed as cash, with other parts of the money being ‘on the books’ or in bonds or loans (promises). The merchant normally was also the ship’s captain and responsible for the construction of the ship and the management of the whole enterprise. He sought partners and, furthermore, borrowed according to “Shipping Terms” for the sea loans or, in regular terms, in view of establishing a risk sharing mechanism. Only on rare occasions did a vessel belong to a single owner.

At the end of eighteenth century in Greece, for instance—one of the main ship-trading countries of the time—returns on the capital of the ship owner as well as the interest charged on the loans were carefully calculated. Loans were on a per-voyage basis and had a duration of a few months. These loans were subject to the “risks and dangers of the sea”, namely if the vessel was lost no claims could made against the property of the merchant shipowner. It is not known what other specific loan types were available.

The entire capital-raising procedure at the end of the eighteenth century was similar to the one that is followed today in the launching of private equity funds. The launch was carried out in a restricted time interval and the personality of the leading fund manager was instrumental in the success of the fund-raising effort. The call was addressed to the important members of the local society. Surely, the merchant circulated a financing proposal for the particular vessel in a closed circle, providing shipping and financial details, a kind of business plan that must have included some estimate of the required financing as well as a certain forecast of revenues to be expected.

To get exclusive and intelligent shipbroking analysis like this each and every morning, simply subscribe to the BMTI Daily Report.

In the Atlantic there is ample reason for the owners to celebrate and enjoy playing around with charterers. Now the charterer’s flexibility is challenged to prepare the ground for a deal with the owner. Kamsarmax owners have been commanding US$ 30,000 daily for a fronthaul run from the Continent.

Handysize owners are somewhat less sanguine and believe the market has peaked – temporarily at least. A 38,000dwt got US$ 13,000 daily for a trip from the Baltic to the East Med, and 33,000dwt was open at US$ 7,500 daily for a trip to the USG, which the same owners covered last week at US$ 9,000 daily, and which rate they have so far not seen this week.

The larger sizes keep running the show from Black Sea. An 82,000dwt tonnage was covered at US$ 19,000 daily from Canakkale to Baltic with redelivery Skaw. An Ultra was offered US$ 27,000 daily from East Med via Black Sea to Singapore/Japan, after owners indicated to charterers US$ 16,500 daily from WC India via Black Sea to the East. The owner was offered US$ 15,500 daily for short period. Continue reading

Coaster freight rates are picking up as “grain market for river tonnage is very hot”, a broker working in the area is telling BMTI, explaining “owners three weeks before were asking for about US$ 19/mt for 3,000mt of wheat for a trip from Rostov to Marmara and last week rates of US$ 25/mt to Marmara were seen”. Freight rates in a range of US$ 23-24/mt are talked for voyages with loading in the Ukraine and heading to the Eastern Med with basis 1,000 discharge. Mid-July shipments are expected to be even substantially higher with rumours around of some US$ 28-29/mt from Russian ports to Izmir, basis 1,000 discharge. According to a local charterer for voyages out of Azov to the Adriatic owners are demanding mid-low US$ 30s/mt, compared to high US$ 20s/mt during the last months.

Seagoing coaster on the other hand still have to accept lower freight rates as the market remains weaker and probably stay so until end of August. A corn shipment of 8,000mt has been concluded at a rate of around US$ 14.50/mt with delivery Constanta and destination in Greek Cyprus. From the Egyptian Med a fertilizer cargo of 3,000mt was talked in a range of US$ 21/mt for a redelivery in the upper Adriatic. Some steels of 9,000mt loading in the port of Novorossiysk saw a freight rate of about US$ 23/mt for delivery in the Egyptian Med and a voyage in the Black Sea from Odessa to Constanta was concluded at a freight rate of some US$12/mt for a shipment of 3,000mt of steel billets

Get weekly updates from all the European short sea markets by subscribing to the BMTI SHORT SEA REPORT today.

Yesterday’s assumption of a possible break seems to be right. With the exception of the fronthaul the Capesizes have recovered the losses they have gone through. The rounds in both basins are talked in a range of US$ 28,500-28,800 daily for the Atlantic side and at some US$ 23-23,300 per day for the Pacific. Iron ore voyages are steadily sailing on their ocean-highways with freight rates for end July loading a bit below US$ 9/mt when coming from Western Australia and a bit above US$ 22/mt when loading port is in Brazil.

The Panamaxes enjoy the growing of the spot freight rates at an even accelerating pace in both hemispheres although business is quite low at the moment. Only a flurry of coal shipments heading to India are seen at freight rates for loading in Eastern Australia at the beginning of August in the mid-high teens. Fronthauls for modern tonnage of around 82,000 dwt are trying to touch the US$ 25,000 daily mark.

The situation for the smaller sizes is without major changes in the Atlantic basin. Spot freight rates keep on climbing and there are business opportunities around. In the East the market can be characterized as flat with some retreat in rates like a 56,000 dwt open mid China going to India via Indonesia at a low US$ 7,000s daily rate.

To read shipbroking analysis like this every day, subscribe to the BMTI Daily Report.

Analyst J Mintzmyer of Seeking Alpha has identified Star Bulk Carriers [SBLK] as a “dry bulk pure play” due to its current value at around US$ 8.4 being a “massive” 35% discount to its NAV (net asset value) and the company’s well-positioned, modern fleet which is set to be 100% fitted with scrubbers before the IMO 2020 regulations come into play. Mintzmyer also sees great potential in SBLK due to the current rally in Capesize rates (with day rates up to US$19,000 this week vs. US$4-7,000 three months ago) and Vale’s resuming iron ore output at its mines that were closed until recently following January’s mine disaster. The analyst has accordingly raised his fair value estimate for SBLK to US$ 14 per share. Continue reading

Containership rates burst into action in the past week with several main benchmark rates leaping by 15-25% week-on-week, including those rates from Shanghai to South America (basis Santos), which rose by more than 25% to reach US$ 2,260/TEU, according to the SCFI. The main index itself increased by a very strong 8.5%, as a measure of all rates together, posting 829.7 by the end of last week. Other big gainers included rates to USWC, which rose by 24.5% week-on-week to US$ 1,720/TEU. Rates to USEC rose as well, if not quite as sharply, gaining 16.0% on the week to hit US$ 2,789/TEU. The combined US destination routes account for 40% of the total SCFI calculation, so their increase has had a significant impact. Rates to Europe were less spectacularly improved with Mediterranean Sea redelivery, in fact, losing 0.7% on the week to settle in the vicinity of US$ 726/TEU, based on the SCFI. Continue reading

Settling from last week’s minor uptick in activity and sentiment—perhaps buoyed by increasing bunker prices as well—rates for northern ships have settled back into their historical sideways motion as owners continue to keep a hard line at operating costs, which is where rates continue to hover dangerously just above. Market dynamics are undeniably poised against owners at the moment, as they have been for most of the year, with open tonnage just plentiful enough in most areas of trade to keep charterers from feeling any urgency to fix on forward positions or give premium rates unless absolutely necessary. With the onset of summer sluggishness and widespread holiday-taking across northern and western Europe, there is little hope for a recovery in the short term. Whether July brings a new wave of demand, inspired by a return of grain from the southern European markets as the Black Sea harvest starts, remains yet to be seen.

Despite slowing in upward momentum, Capesize voyages do not appear to have hit a wall yet with modest improvements taking Brazil/ARAG voyage rates toward US$ 8.4/mt and Brazil/China toward US$ 18.5/mt. Whether they will keep rising over midweek is another issue, brokers strain to remind. Pacific RVs seem to be the first rates to buckle under the pause in demand with a flat and even rate of US$ 17,000 daily the newly downgraded (if just slightly downgraded) level for 180,000mt cargoes. The Atlantic spot basin, by comparison, is still going strong with a surprisingly robust US$ 1,000 upgrade on Tuesday taking average freights over US$ 19,000 and suggesting US$ 20,000 daily on the horizon.

The Panamaxes‘ day in the sun seems to have arrived after several weeks of suffering pressure on rates and less-than-spectacular sentiment. The upturn is most notable within the western hemisphere where owners are already seeking long haul rates at US$ 1,000 premiums to what they were asking for at the end of last week. A case in point is the trans-Atlantic round voyage from the Continent, which can now fetch upper US$ 8,000s daily on modern tonnage after settling for anything in the US$ 7,000s less than a week before. Pacific business is back in action as well with NoPac rounds pushing toward US$ 9,000 daily on standard tonnage to Singapore.

Russia said it will begin enforcing regional quotas and limiting its exports of ferrous scrap beyond the Eurasian Economic Union (EEU) starting in July and continuing for the six months thereafter. Further, starting next year, Russia says it will be handling scrap exports exclusively with an exchanged-based tender process. A bill in support of the new measures is expected to be introduced in September. The quotas will involve a series of specific coefficients to be assigned to each region in proportion to the shortage of ferrous scrap in the region. The lowest coefficient of 0.5 will be applied to Russia’s southern regions while the highest (1.5) will be set for Arkhangelsk. How this will effect scrap shipments within Europe is yet to be seen, especially for Turkey, the world’s top scrap importer. Turkey’s imports of shredded ferrous scrap, at any rate, have increased considerably in June so far with new data showing that Turkish mills bought 238,500mt of shredded scrap—comprising 15 single cargoes—since the start of June, which is more than twice the volume purchased by Turkey for the entirety of May (108,500mt). Scrap market observers speculate this increase in shredded steel imports to Turkey reflects a desire to build scrap stocks at presently favourable prices rather than in response to any growth in demand for domestic steel production.

The chartering market is still looking for direction and seems at odds to find it. An abysmally poor rate of US$ 7,000 daily from the Baltic via Continent was reported done an Ultramax open in the Baltic. Steel operators were predicting a flurry of fresh orders off the Continent for Handysize tonnage and have already fallen prey to this forecast by getting in tonnage of 30-38,000 dwt for a trip from the Continent-US-NCSA range at US$ 8,000-9,000 daily. Swire are still open to cover an Ultramax from the Continent to Brazil after they failed to look at one at US$6,500 daily, which is gone now. For a quick local employment for Supramax tonnage charterers were thinking along the lines of US$ 5-6,000 daily, which one Ultra owner would not do below US$ 10,000 daily. Nut coke charterers were seeing 37,000 dwt tonnage at the daily equivalent of below US$13,000.

Copenhagen-based bulk carrier operator Baltnav reports that it secured a profitable 2018, which has allowed it to expand globally with plans to open a new office in Brazil as well as new forays into ship management. The company’s net profit jumped to US$ 4.2m in 2018, solid performance for a company dealing exclusively in smaller sized Ultra-Supra-Handy bulk vessels. Baltnav, which operates a fleet of 47 vessels from Ultramax to Handysize types, employs a business model focused on extremely short charter contracts, typically only from one to three months of period trading. Nearly half the fleet is chartered for single sailings while a small percentage is secured on longer 12-month period contracts. Continuing with this model, the company says that it expects to secure a profit in 2019 as well, although most likely falling below last year’s levels.

Necessity is the mother of invention, as they say, and this year’s challenging dry bulk market has seen quite a bit in the area of invention among owners seeking new ways to combine forces. This week, three Hamburg-based companies—Bertling, Nordic Hamburg and Oskar Wehr—announced plans for a new joint venture called OneBulk, intended to start operations in Hamburg and Singapore at the beginning of July. The combined fleet of the owner-operators would amount to about 50 vessels ranging from the Handysize to Kamsarmax sizes. In a statement, OneBulk said, “the partners will share their know-how and expert teams to leverage the best of all three companies and provide comprehensive commercial management solutions and associated services to vessel owners, charterers and investors.” The pool is open to new partners that can provide competitive solutions and “maximum flexibility”.

The recent Capesize rally—which has seen freights return to January levels enjoyed before the Brazil mine disaster and its related freight crisis—came to a pause at the resumption of business this week with few major changes seen either up or down, but some worrying corrections on the trans-Pacific RV. The Pac RV had been rising rather rapidly in recent days, only to see a sharper reversal of some US$ 300 (the strongest of all routes) in its assessment to settle in the US$ 17,000s. Another day of trading will likely indicate whether this is a speed bump or the end of the most recent recovery cycle. For now, with new fixtures lacking, the latter option seems most likely. A stretch of noncommittal days from charterers has left the Panamax markets high and dry at this stage of the month of June with owners left to hustle to find employment in a newly unsure market. TARVs have started to turn downward more quickly than in day past with the US$ 8,000s having already collapsed to the US$ 7,000s and trends suggesting that US$ 6,000s are not impossible before the week is over. Front hauls have also slowed with US$ 17,000 daily about the best that an ex-Continent trip can fix.

Increased coal movements around the Sea of Azov have helped buoy sentiment and rates to a limited degree, at the very least halting the slow decline seen in recent weeks. And amid the dominant sideways trend, there is word of some even fixing slightly higher levels over last-done as charterers prove willing to pay premiums for early June dates. Rising activity for scrap and coal shipments in the Black Sea and Sea of Azov comes as an encouraging trend for owners, who remain nonetheless sceptical about how much uplift this activity can or will provide. Azov to Marmara shipments continue to fix high teens of US$17-18/mt on 5,000mt (46′) grain. Coal is fixing similar rates on this run. Inter-Black Sea grain ex-Novo to Marmara are at US$ 15-16/mt.

Get news and updates from the European short sea market by subscribing to the BMTI SHORT SEA REPORT today.

Again taking a turn back toward the positive, rate trends ended up flatter than the week before, if only because the positive and negative movements were more uniformly distributed among various trade routes. On the whole, according to the Shanghai Containerized Freight Index, rates only declined by a minimal 0.3% on average even as some rates saw significant gains ex-Shanghai such as rates to PG, which rose 7.5% week-on-week to US$ 657/TEU while others saw considerable declines such as those to South America, which were down 9.5% on the week to US$ 803/TEU. These extreme points of departure notwithstanding, the market for containership freights behaved rather timidly over the past week with no more than 3% up or down seen on the majority of freights, the aforementioned excepted. On the buoyant end (after PG redelivery) shipments to Europe saw nearly 3% improvement (up 2.8%) on the week to close at solid levels of US$ 743/TEU while Mediterranean redelivery enjoyed upgrades of 2.0% week-on-week to settle at US$ 710/TEU. On the negative side of things, rates to the USWC and USEC fell by 3.4% and 2.2% on the week to US$ 1,294/TEU and US$ 2,540/TEU, respectively, while rates from Shanghai to East-West Africa also declined by about 2.4% week-on-week to close within the range of US$ 2,554/TEU.

NASDAQ-listed owner-operator Pangaea Logistics Solutions [PANL] says it plans to offer shareholders a quarterly dividend for the first time since going public in 2014. The US bulk carrier firm says it will pay US$ 0.035 from 11 June. CEO Ed Coll said the company had a proven business model and that after reinvesting profits in operations, Pangaea expected to become a leading “growth and income” company that cares about enhancing shareholder value. The company says it has managed to stay profitable, despite the ongoing dry bulk crisis, by offering logistical solutions to industrial clients with its owned and chartered-in fleet. Pangaea boasted income of US$ 3.7m against revenues of US$ 79.5m in Q1-2019.

Greek owners are said to be little nervous about 2020 with the upcoming challenge to meet the now sulphur cap standards. Some believe this could lead to a three or four-tier market. The uncertainty is worrying them without doing too much about it. The Atlantic chartering market is lacking momentum, whilst South Africa is flourishing and of course the South American area is still being dominated by Kamsarmax demand, whilst other sizes are trailing. Off the Continent, voyage rates for local trading are equivalent to US$ 9,000 daily for Ultramax vessels. Scrap charterers were seeing US$ 15-16,000 daily for a trip to Bangladesh which sounds unrealistic. Handysize freight rates have been about holding with a 32,000 dwt fixed into the central Med in the region of US$ 9,500 daily with delivery in the Baltic. The dearth of inquiry from Med-Black Sea is keeping rates at pretty low levels. On the other hand, achieving the equivalent of US$ 11,000 daily on a 62,000 dwt from West to East Med is not to be sniffed at.

Having had a relatively beneficial week, Capesizes start to flatten as the week ends with owners hoping that sentiment stays in their corner with trends moving sideways and some already trending downward. Front haul trips seem to have already peaked with the mid US$ 20,000s moving back into the US$ 24,000s and Pacific RVs into the US$ 11,000s. With Vale’s output very much in question and US-China trade conflicts at the fore, it remains to be seen what May has to give for this most volatile of bulk carrier sectors. But owners remain optimistic as ever. Panamaxes continue to enjoy their day in the sun with solid improvements on all freights observed across the board and charterers reluctantly giving premiums over last-done levels on nearly every rate. Front hauls that were getting low US$ 17,000s early in the week are now commanding high US$ 17,000s and even as much as US$ 18,000 daily in some cases. With little reason to do otherwise, Supramax owners are pushing for generously improved rates on all freights coming from the USG as more than US$ 12,000 daily has been observed on freights to the Continent and US$ 18,000 on front hauls with NoPac redelivery. The rest of the market is less buoyant by comparison, but owners are undoubtedly inspired to seek higher freights on nearly every rate.

To read shipbroking analysis like this every day, subscribe to the BMTI Daily Report.

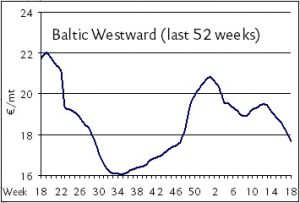

Declines in freights seem to have started to accelerate as the days of May lengthen with the lingering impact of holiday-strewn weeks having the expected braking effect on business activity in general. Charterers have given up trying to play nice for the time being as owners note a more aggressive attempt to push freights to new lows. Cargo demand, despite being promised to return in earnest after Q1, remains less than spectacular, to put it nicely. Even for a European coaster market that has seen very little tonnage expansion in recent years, and one that remains thankfully tightly-bound to cargo demand, the wide availability of tonnage is undeniable. High teens that were tracked for most of the year on the westward Baltic route—from Balticum to ARAG—in the range of EUR 18-20/mt are now moving toward EUR 16-17/mt and lower, brokers report. Longer runs from the German Baltic to WCUK are looking at mid-low EUR 20s/mt of about EUR 23-25/mt, depending on terms. This remains true, although traders are already assuming the same business will be going for EUR 22-23/mt by the end of the month. The reverse trip from WCUK to the lower Baltic is seeing 3,000mt general cargoes fix middle teens of EUR 14-15/mt.

Declines in freights seem to have started to accelerate as the days of May lengthen with the lingering impact of holiday-strewn weeks having the expected braking effect on business activity in general. Charterers have given up trying to play nice for the time being as owners note a more aggressive attempt to push freights to new lows. Cargo demand, despite being promised to return in earnest after Q1, remains less than spectacular, to put it nicely. Even for a European coaster market that has seen very little tonnage expansion in recent years, and one that remains thankfully tightly-bound to cargo demand, the wide availability of tonnage is undeniable. High teens that were tracked for most of the year on the westward Baltic route—from Balticum to ARAG—in the range of EUR 18-20/mt are now moving toward EUR 16-17/mt and lower, brokers report. Longer runs from the German Baltic to WCUK are looking at mid-low EUR 20s/mt of about EUR 23-25/mt, depending on terms. This remains true, although traders are already assuming the same business will be going for EUR 22-23/mt by the end of the month. The reverse trip from WCUK to the lower Baltic is seeing 3,000mt general cargoes fix middle teens of EUR 14-15/mt.

The decent handful of new TCs that came through for the Capesizes at midweek were not repeated by the end of the week, but no bother. Sentiment has been sufficiently triggered to start rising once again as the long-delayed requirements of the holiday period seem to be again entering the spot market with employment enquiries being reported by owners in the Atlantic and Pacific alike. Front hauls have been broadly upgraded with as much as US$ 23,500 daily on offer for standard tonnage from the Continent into the CJK area. Voyage rates enjoy another boost as well with Brazil/China climbing back over the US$ 15/mt marker with some owners already claiming to have US$ 16/mt on lock for end-May.

Perhaps inspired by the same gust of wind that has lifted the Capes—not to mention a new sense of purpose in the East—Panamax freights are firming a little bit faster, suggesting potential for a real recovery by next week, assuming trends hold steady. Front hauls have been getting fixed in the mid US$ 17,000s we are told, though this run is still too little frequented to make a fair assessment. Aussie rounds are pushing toward US$ 10,000 on Kamsarmaxes.

Improvements build for Supramaxes on Black Sea delivery with front hauls said to be hovering under US$ 13,000 daily on modern ships. Trans-Atlantic trades ex-USG remain problematic, but minerals on Tess 58s are securing steady rates of US$ 11,000 and up on UKC-Med redelivery with talk of US$ 11,500 on the horizon for the same business. Indo rounds are onwards and upwards with Supramax tonnage having set the new high water mark at US$ 9,500.

To read shipbroking analysis like this every day, subscribe to the BMTI Daily Report.

Impairments on credit for shipping and petroleum investments of Danske Bank fell in the first quarter of the year, according to the Danish bank’s newest interim report. Loan impairment charges saw a “significant reduction” in the quarter against loan exposures to the industries of shipping, oil and gas, said the report, noting that high reversals were especially seen in the area of Norwegian shipping, oil and gas. Net reversals of DKK 48m in total in the quarter were described as a “very low level” of impairment charges for the bank, according to the report, though these industries remain a “focus area” considering that the shipping market has had a “slower pickup” than was expected. Danske Bank’s Stage 1 gross exposure to shipping, oil and gas was at DKK 41.6m in the quarter, down from DKK 43.9m in Q4-2018.

Recent rainfall in Western Europe has boosted output forecasts for the EU wheat crop, though analysts warn that more rain will be required to avoid potential crop damage from drought. Forecasters remain positive for EU wheat as increased sowings and more favourable weather conditions this year (including a mild winter) suggest that output could return to normal after last year’s drought-afflicted harvest. The official forecast for EU common wheat production in the 2019-20 season was raised to 141.3 Mt this week, putting it a full 10% above last year’s output.