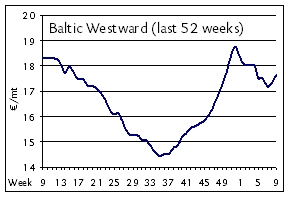

The spot market remains tilted toward owners with activity still holding to higher-than-average levels in the northern trades of the Baltic Sea and North Sea coaster routes. But with rates still not demonstrably higher than they were 2-3 weeks ago, there is also little basis to call it a rally of the kind clearly taking place across the Atlantic Handy bulk sector. UK exports to North Spain are sporadic—as strike conditions at Spanish ports have slowed trade—with rates in the range of EUR 14-17/mt, interestingly with delivery WCUK on the lower end and ECUK on the higher end of that range on parcels of 4-5,000mt. Westward trips from ARAG to WCUK are fixing up to EUR 15/mt and closer to EUR 13-14/mt on ECUK redel. Among all the northern trade regions, the Baltic Sea is still the strongest in terms of supply-demand gap with just a slight increase in demand from present levels likely to set off the long-desired freight hike that shipowners have been predicting. Tonnage is decidedly less tight in the Irish Sea and North Sea, though charterers are having no success in pushing freights any lower than last-done levels with westward redelivery to Ireland from the German Baltic getting EUR 15/mt and rumoured to be fixing up to EUR 15/mt on 5,000mt parcels. Better weather seems to have been a modest boon to owners with charterers more willing to put cargoes on the market without the risk of having them tied up at port due to stormy conditions. Earnings have been generally unchanged on standard trans-Baltic shipments with 3-4,000 dwt ships still getting mid EUR 2,000s of about EUR 2,400-2,600 daily on non-ice class tonnage. Most owners remain optimistic about March with trends among the deep-sea bulkers also providing some encouragement, however indirect.

The spot market remains tilted toward owners with activity still holding to higher-than-average levels in the northern trades of the Baltic Sea and North Sea coaster routes. But with rates still not demonstrably higher than they were 2-3 weeks ago, there is also little basis to call it a rally of the kind clearly taking place across the Atlantic Handy bulk sector. UK exports to North Spain are sporadic—as strike conditions at Spanish ports have slowed trade—with rates in the range of EUR 14-17/mt, interestingly with delivery WCUK on the lower end and ECUK on the higher end of that range on parcels of 4-5,000mt. Westward trips from ARAG to WCUK are fixing up to EUR 15/mt and closer to EUR 13-14/mt on ECUK redel. Among all the northern trade regions, the Baltic Sea is still the strongest in terms of supply-demand gap with just a slight increase in demand from present levels likely to set off the long-desired freight hike that shipowners have been predicting. Tonnage is decidedly less tight in the Irish Sea and North Sea, though charterers are having no success in pushing freights any lower than last-done levels with westward redelivery to Ireland from the German Baltic getting EUR 15/mt and rumoured to be fixing up to EUR 15/mt on 5,000mt parcels. Better weather seems to have been a modest boon to owners with charterers more willing to put cargoes on the market without the risk of having them tied up at port due to stormy conditions. Earnings have been generally unchanged on standard trans-Baltic shipments with 3-4,000 dwt ships still getting mid EUR 2,000s of about EUR 2,400-2,600 daily on non-ice class tonnage. Most owners remain optimistic about March with trends among the deep-sea bulkers also providing some encouragement, however indirect.

Read more news about European coaster markets in the BMTI Short Sea Report.